Most Retirees Have 80% of Their Savings After 20 Years

Practical Tools to Tackle the Psychological Challenges of Retirement

What would you do with an extra $80,000 per year?

I love following the blogger Root of Good. He was an early adopter of the early retirement movement. He is awesome because he publishes all his family’s finances every month, sharing exactly how much money he has and how he spends.

His family seems to live well while spending very little. They do extended travel, often on discount cruises, and have been all over the world since I've been following him. So kudos to him and his ability to hunt for discounts and use credit card points.

I find his numbers fascinating. They illustrate a challenge that many diligent savers and investors contend with.

Last year, he spent $40,000. That’s about $3,300 per month.

To be able to spend $40,000 per year, you need $1M invested (based on the 4% rule). That's close to what he had when he retired ten years ago.

And how much does he now have? $3.6M.

He could now literally triple his spending to $120,000 per year and still have some margin for safety.

He keeps spending so little that his portfolio is growing faster than he can spend it down.

I respect his ability to live so cheaply. But he really doesn’t need to. He has an extra $80,000 per year. I bet we can all think of ways we could spend that on something meaningful.

While he is an extreme example, he is not alone. I want to talk about why this happens and what we can do about it.

The Psychology Behind Retirement Underspending: Why Retirees Hoard Money

Take a moment to think about the last time that you spent a large enough amount of money that your net worth went noticeably down. You may have bought a car, renovated a bathroom, or splurged on a big trip. How did it feel to spend like that?

Now think ahead. How would it feel to spend like that regularly for all the years of your retirement? How easy or hard would you find it?

Why Some Retirees Never Touch Their Savings

After almost 20 years in retirement, most current retirees still have >80% of their pre-retirement savings, according to research from BlackRock.

There’s a growing body of research that many retirees aren't drawing down their retirement portfolios. They are opting instead to live on Social Security, dividend income, and minimum required distributions.

After almost 20 years in retirement, most current retirees still have >80% of their pre-retirement savings, according to research from BlackRock. Consider that most retirement plans are designed to last 30 years1.

If these people plan to spend the remaining 80% in their last decade or so of retirement, they will find it difficult. Research also shows that spending tends to decline as we age, even when factoring in health care costs2.

Why does that matter for someone who is working?

In our working years, most of us are so focused on accumulating more money that we don't think about how we will eventually spend that money.

That can lead to over-saving, putting off our goals, and working more than we need to.

Loss Aversion and Mental Accounting: The Psychology of Retirement Spending

The evidence shows this pattern clearly. A study by Wolfe and Brazier found that most retirees match spending to income, much like they did when working and accumulating assets for retirement.

That’s because we view income from guaranteed sources like pensions, Social Security, and dividends like the income from our paychecks. Over the decades, we built a habit of spending only our income and not our savings.

We don't have the habit of selling shares or drawing down savings to fund our lifestyle.

Spending our savings and investments feels like taking a loss. And losses are more psychologically painful than wins. And that phenomenon seems to get larger in retirement. “Retirees display ‘hyper-loss-aversion’ and are up to five times more loss-averse than the average person.3”

That loss aversion is exacerbated by what psychologists call the Endowment Effect. Once wealth is "yours," we don’t want to give it up. We want to keep what we have.

Worrying about spending in retirement affects our decisions leading up to retirement and leads us to work longer than we need to. This happens so often that there’s a name for it: One-More-Year Syndrome. As in “I probably have enough now, but I’ll work just one more year to be sure.”

Practical Worries That Amplify Caution

Being cautious and conservative makes a lot of sense up to a point. Longevity uncertainty tops the list of concerns for many retirees - we don't know if we’ll live to 85 or 105. The uncertainty of outliving our savings makes us hold back on spending.

Healthcare and long-term care fears also loom large. Many retirees are holding a significant portion of their assets to self-insure against the risk of high medical, long-term care, and death expenses. That’s also good thinking as long as it’s not taken to extremes.

How to Overcome Retirement Spending Worry

There are a few ways you can prepare yourself for this challenge that just about every saver will have to contend with.

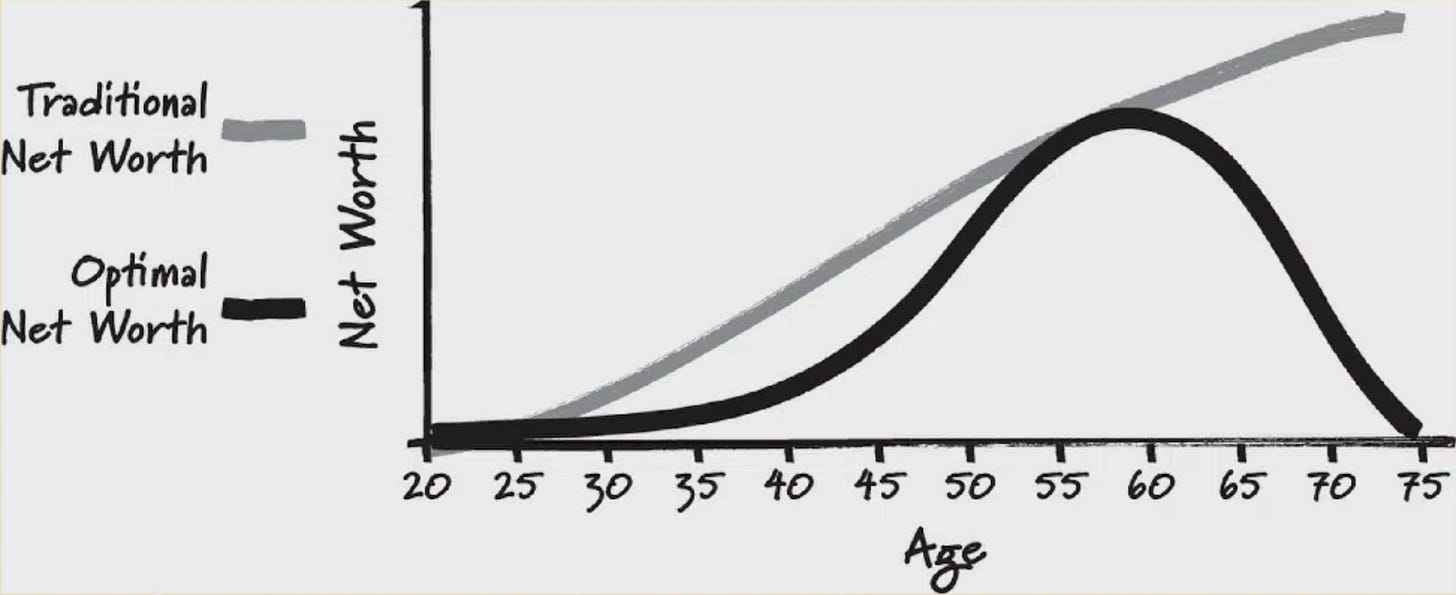

Die With Zero Mindset: Spending Money for Maximum Life Value

Having some mental models that help us shift our mindset can be helpful here. The best thinking I’ve seen in this area comes from Bill Perkins' book "Die with Zero" where he provides a few practical frameworks to help you spend more once you are able.

Perkins points out that many experiences have expiration dates. For every experience, there’s a curve of diminishing returns. A hiking trip through Patagonia is going to be totally different at age 45 than at 75. If we wait too long, we can miss out on experiences entirely.

He advocates for doing an exercise called "time bucketing.” You identify which experiences you want to do in which decades based on when they'll deliver maximum enjoyment for you. It’s like a bucket list organized by your age. Maybe you want to take your extended family on vacation in your 50s, do a cross-country RV trip in your 60s, and do quiet cruises in your 70s.

Thinking deeply about how you want to spend your money and having a concrete plan can make spending feel strategic and less like a loss.

Safe Withdrawal Rates and Bucket Strategies for Retirement Spending

Tactical spending money management strategies can also provide a practical approach to helping be comfortable spending down assets.

One strategy is dynamic spending. In dynamic spending, you set up guardrails to adjust your spending based on market performance. Set boundaries - for example, spend 3-5% of your portfolio annually, but never below $60k or above $100k. When markets go up, you can do more. You could book a nicer hotel, redo your bathroom, or splurge on an expensive restaurant. When markets are down, scale back.

Another strategy is often called money bucketing, where you set up separate buckets of money based on when you will need it. For example, keep a short-term bucket of 3-5 years of expenses in cash for immediate needs. Keep a medium-term bucket of bonds and income assets for mid-term goals. And keep a long-term bucket of stocks and growth investments. As one bucket empties, use the next one to refill it.

Are Annuities Worth It? Creating Your Personal Pension for Guaranteed Income

The last approach I want to share is the most controversial and least understood = Annuities. Even by financial advisors, annuities are not always well understood4.

In the simplest form, an annuity is a contract with an insurance company. You give them money up front, and they promise to return monthly payments to you in the future, often for the rest of your life. You can think about it like buying your own pension.

Retirees with guaranteed income sources spend roughly three-quarters of their income, while those relying on portfolios spend only two-thirds. Annuities can help us get over the psychological barriers that lead to underspending.

Annuities carry baggage in personal finance circles, often deservedly. Many products have high fees and confusing terms. Inflation can eat away at the income. The sheer variety makes comparison difficult. And you have to accept the opportunity cost of not investing that money elsewhere. All of these are significant downsides.

Annuities are often thought of as insurance for living an extra-long life. They are useful for that. But they have another overlooked upside. Research shows that good annuity products solve real psychological barriers that prevent us from underspending throughout retirement.

Retirees with guaranteed income sources spend roughly three-quarters of their income, while those relying on portfolios spend only two-thirds. Annuities can help us get over the psychological barriers that lead to underspending.

There are many different types of annuities with a range of options and technical specifics. A Single Premium Immediate Annuity (SPIA) starts income now and is usually the simplest. A Deferred Income Annuity starts later and hedges very old age. Fixed indexed annuities protect principal but cap upside. Variable annuities invest in funds and fees can be high, especially with riders.

When evaluating annuities, generally favor simple products. Consider the tax impact on you over the life of the annuity. Compare quotes from multiple insurers. The complexity can make working with a financial professional who is a fiduciary worthwhile to evaluate the options.

How Much Will You Need in Retirement?

If you are still in the saving stage of your journey, retirement may still feel off in the distant future. Recognizing these psychological barriers now can help you build a better financial plan and prevent working years you don’t have to, while reducing worry and anxiety. To summarize:

Have a plan for what you want to do and experience.

Use dynamic spending rules or bucket strategies to manage your funds.

Consider guaranteed income sources like annuities to cover your baseline needs, freeing up portfolio money for discretionary spending.

Need help thinking through your specific situation? Have questions about any of these strategies or want to discuss how they apply to your goals? Email me at jamesdbaldwin@substack.com - I respond to every message and love helping people think through these decisions.

https://www.firsttechfed.com/articles/invest/the-psychological-side-of-spending-your-retirement-savings

https://www.rand.org/news/press/2022/12/07/index1.html

https://www.newyorklife.com/assets/newsroom/docs/pdfs/114_The_Decumulation_Paradox_011222.pdf

https://image.s12.sfmc-content.com/lib/fe3211737164047a741174/m/1/1832ae10-e7bb-4df3-85f6-0be82d91e93a.pdf