Most People Park Cash in the Wrong Place

Most people leave $1,000+ on the table by keeping cash at Chase, Wells, or BofA. Here's where to move it instead.

Keeping cash at a mega-bank is usually an expensive mistake. Chase, Bank of America, and Wells Fargo pay essentially zero interest on your cash.

Holding $30,000 at Chase can easily cost you $1,000 per year. Do you like Chase enough to pay that?

There are much better places to park cash. This post shows how to pick a high-interest account you can set once and never worry about again. It takes about 15 minutes.

If you have money for an emergency fund, travel, or a future down payment, read on.

What cash are we talking about?

I’m going to show you what to do with your savings. By savings we mean either:

Money you might need at any moment. Your emergency fund falls here. So does that “not sure yet” cash, where you don’t have specific plans but want flexibility. Or,

Money earmarked for something specific. Travel next summer. A car in six months. A house down payment in a few years. These are still relatively short-term needs, and you generally have an idea of when you’ll need the money.

We are not talking about money for retirement, long-term wealth building, or anything beyond about 5+ years. Those should be invested.

Option 1: High-Yield Savings Accounts (HYSA)

For most people, a high-yield savings account (HYSA) is the best all-around savings option.

A HYSA is a savings account that pays a competitive variable rate. The best ones live at online banks without physical branches, which is how they can afford to pay you more. Right now, the best HYSAs are paying around 3-4%.

Savings accounts have another advantage - FDIC insurance. The US government guarantees up to $250,000 per depositor, per bank. You don’t have to worry about your bank failing.

What are the advantages:

Clean separation from your checking account, which helps you not spend your savings

Good for both emergency funds and specific savings goals

Most let you create named sub-accounts for different goals, like “Travel Fund.”

Easy to automate transfers

What to look for in a HYSA:

Competitive yield

No monthly fees

No minimum balance requirements to earn the rate

Fast transfer speeds and reasonable withdrawal limits

A bank with a history of paying competitive rates consistently

Some banks play games. They offer a great rate to attract you, then quietly drop it six months later when switching feels like a hassle. Stick with providers known for staying competitive.

My favorite options for online savings accounts

I like these banks because they all have a strong history of paying competitive rates, no fees or minimums, have good online platforms, and are backed by large public companies.

Ally Online Savings: 3.3% interest rate, no fees, no minimums

Capital One 360 Performance Savings: 3.4% interest rate, no fees, no minimums

Marcus by Goldman Sachs: 3.65% interest rate, no fees, no minimums

All rates as of December 2025. Rates change often, so treat all rates in this article as a snapshot and double-check.

I have personally used Capital One for many years, and I have clients who use Ally. I have consistently heard positive reviews of Marcus, but I don’t have personal experience with it.

Use your HYSA to automate your financial life.

One of the best things you can do to build wealth and simplify your life is to set up automatic transfers from your checking account to your HYSA. Figure out how much you need month-to-month in checking, then set up a recurring transfer to move the rest a day after payday.

If you’re saving for multiple goals, either open separate HYSAs or use sub-accounts within one account. This automation matters more than you think. It removes decision fatigue and makes saving a default behavior instead of something you remember to do. I’ve used this technique to automatically save for replacing my car, and it’s allowed me to never have a car loan. I can always pay cash.

Option 2: Money Market Funds (MMF)

A money market fund (MMF) is another good option to hold cash.

It is a mutual fund designed to maintain a stable $1 share price. It invests in ultra-short-term, high-quality investments, such as government bonds. The goal is to generate yield with low risk.

The advantage of a MMF is a slightly higher interest rate. Right now, MMFs are paying 0.2-0.4% more than most HYSAs, as of December 2025:

Vanguard VMFXX: 3.72%

Fidelity SPAXX: 3.42%

Schwab SNVXX: 3.47%

A difference of 0.3% equates to about $30 per year on $10,000. It’s not life-changing. But it’s worth considering if you have a lot of cash.

The downsides of a Money Market Fund vs. HYSA

MMFs are not FDIC insured. Money market funds try to keep each share worth $1, but that isn’t guaranteed. In real life, they almost always succeed, though there have been rare exceptions when they’ve lost money.

Access timing is slower. Moving money from an MMF to your checking account usually takes 1-2 days.

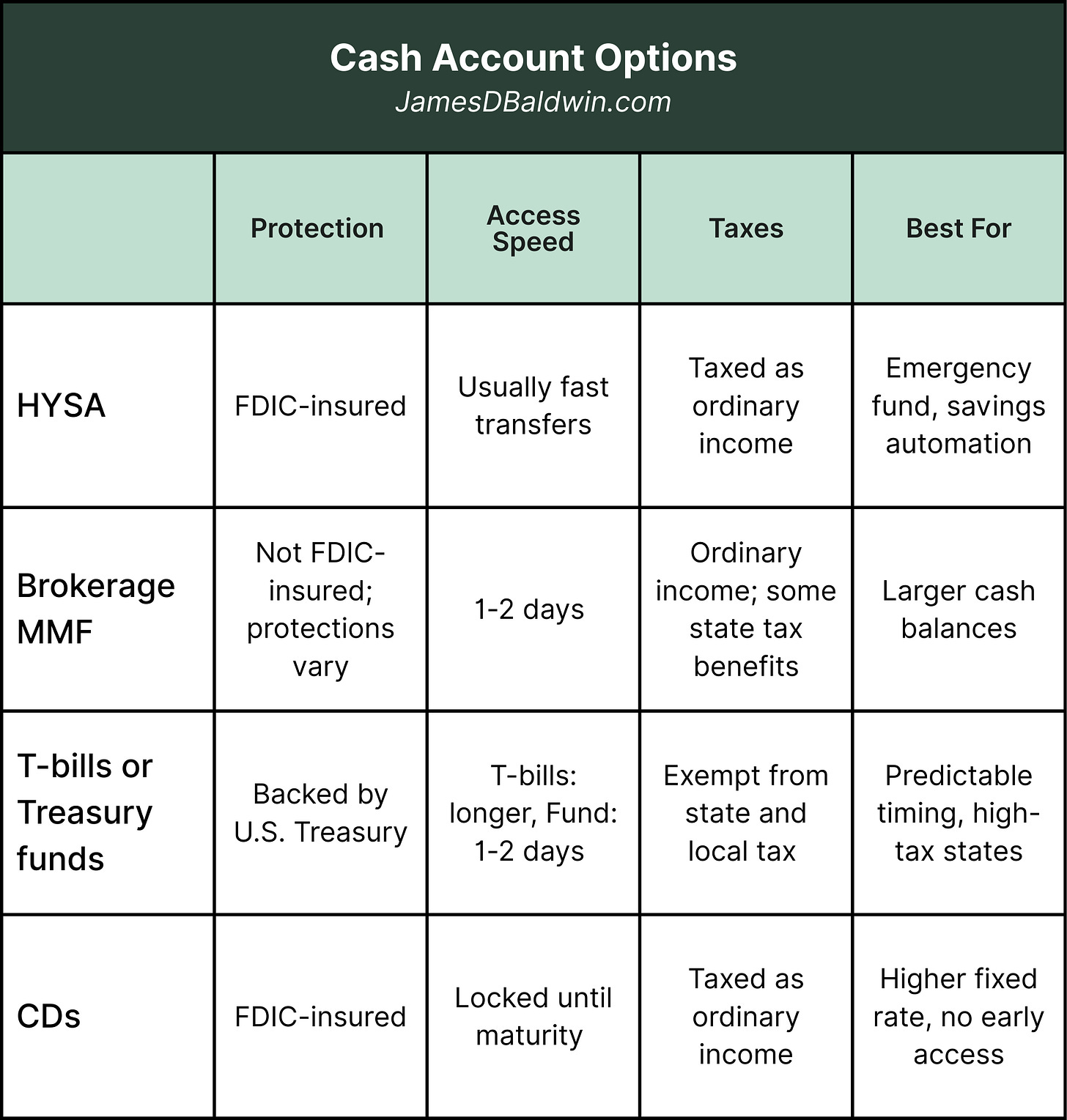

Lesser Common Options: T-Bills Or CDs

A HYSAs or MMFs is the best option for most people.

But there are a few situations where you might consider Treasury bills (T-bills), which are short-term loans to the U.S. government, or Certificates of Deposit (CDs), which are bank accounts that lock your money for a fixed period in exchange for a set interest rate.

T-bills are worth considering if:

You have a known spending date - like a house down payment and tuition payment. You can buy T-bills that mature right when you need the cash.

You’re in a high state tax bracket (eg, high income in California, New York, New Jersey). Treasury interest is exempt from state and local income taxes. At the same time, HYSA interest and most MMF income are taxed as ordinary income at both the federal and state levels. (However a portion of some MMF’s are state-tax exempt.)

You can buy T-bills directly through TreasuryDirect and manage maturities yourself, or buy a short-term Treasury fund at your brokerage for less hands-on management.

CDs are worth considering if:

You have a known spending date and are sure that you will not need the money early. There are early withdrawal penalties on CDs.

You are willing to lock in money and deal with a little extra hassle in return for a slightly higher rate.

You value FDIC insurance and the simplicity of a bank product.

Right now, CD rates are around 4%, which is not dramatically different from HYSAs.

Pick One And Automate Your Savings

A High Yield Savings Account (HYSA) is the best all-around option for the vast majority of people with typical needs to park cash for savings or emergency funds. It’s the most flexible, easiest to automate, and comes with FDIC insurance.

If you have $50,000+ and already use a brokerage, a money market fund is worth considering for the extra yield. If you’re in a high-tax state with a large cash balance, look at Treasury funds or direct T-bill purchases.

The important thing is to pick one today and set up automatic transfers. Your cash should work for you, not sit idle earning 0.01% at a bank that doesn’t care whether you stay or leave.

Disclaimer: This article is for general education only. It isn’t personal financial advice. I don’t know your full situation, goals, or risk tolerance, and nothing here should guide your decisions on its own. Do your own research or speak with a licensed professional before acting on any investment ideas.

I’d give an honorable mention to muni funds. Living in California, my Cal Muni fund currently pays over 3%, tax free.

Why haven’t I done this math before 🤦🏻♂️ so obvious now