How you should optimally rebalance your index portfolio in 2024.

Think you own too much stocks? Here's how to strategically rebalance.

I recently got this question:

I'm 50, soon to retire, and >90% equities. This sort of crept up on me, in a strange way, which in hindsight was not smart. I would like to be more like 30% bonds/cash. :(

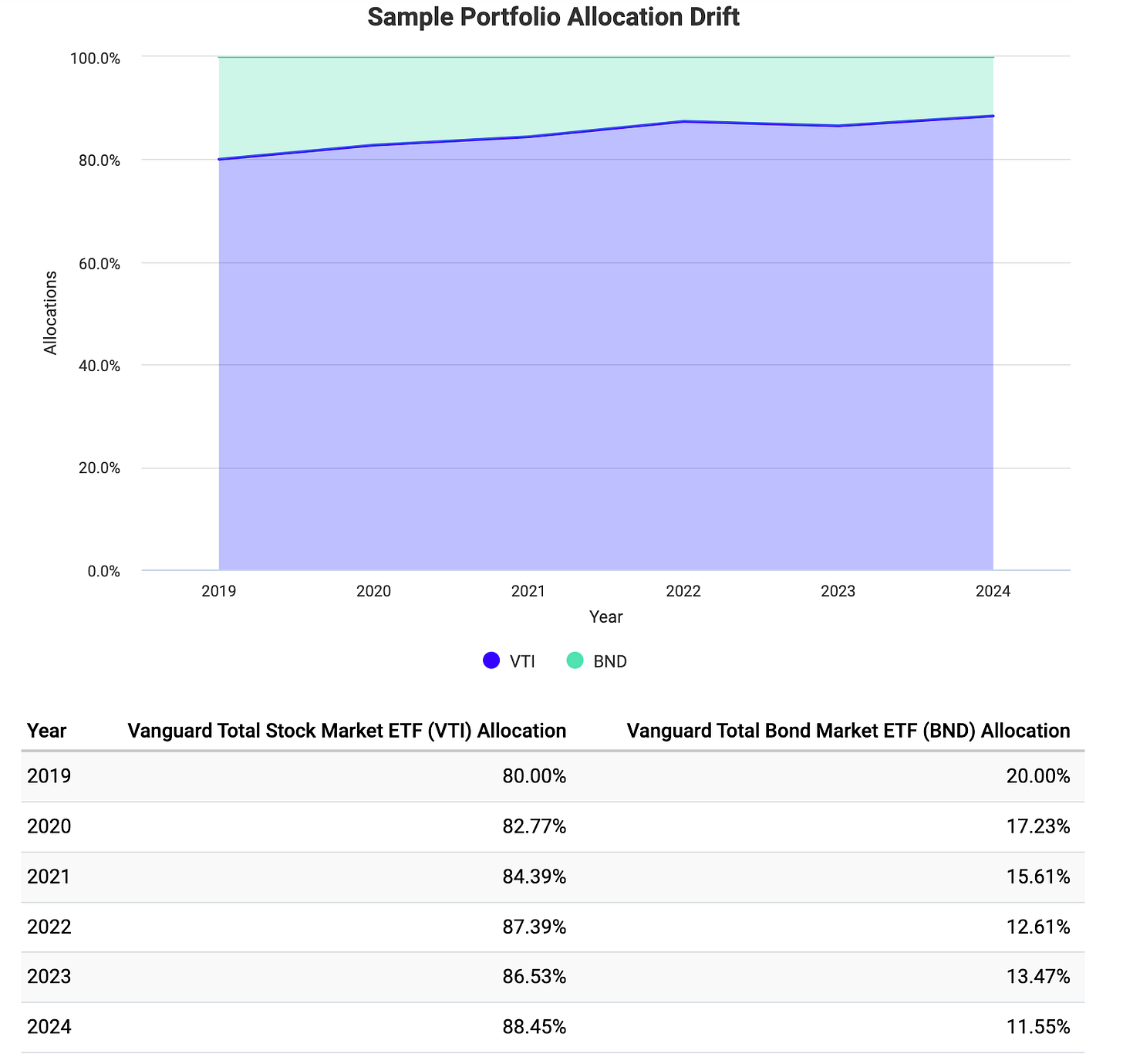

This is the case for many people because the stock market has been on quite a run. For example, if someone was 80% stocks and 20% bonds five years ago and hasn’t rebalanced, their portfolio has drifted to 88%/12% because the stock market has increased so much relative to bonds.

This person is worried about their risk exposure as they approach retirement age. They are right to be. Having an equity-heavy portfolio around retirement age increases the sequence of return risk, one of the primary risks that people who intend to retire before 65 should be worried about.

How should someone increase their bond portfolio optimally?

Let’s take this person’s plan to rebalance from a 90% stocks / 10% bonds portfolio to 70% / 30%.

We’ll leave aside whether this is the correct allocation. It certainly is within the range of reasonability.

Principle: Minimize current taxes

Most people will expect to have lower taxes in retirement. That’s because you don’t have a job. Yes, you must replace your income with cash flows from our investment portfolio. But you don’t have to replace 100% of your pre-retirement income because you no longer have to save for retirement! People also tend to have fewer work-related expenses, like commuting. A common heuristic is to plan to need 70-80% of your pre-retirement income. You may also have less taxes by taking advantage of Roth accounts and lower capital gains rates.

This implies that your tax rate is likely higher now than later. That means we want to prioritize minimizing taxes now when 1.) our tax rate is higher than it will be later, and 2.) avoiding taxes now has the added benefit of being able to earn a return every year in the future on the money we would have otherwise paid in taxes this year.

How do we strategically rebalance?

1. Rebalance with future cashflows

If you still have several years to retire, transition to making most or all of your future investments to bonds. For example, switch your 401k contributions going forward to all bonds.

This prevents having to sell other assets that are potentially taxable. It has the added psychological benefit of making the transition slow and gradual.

You can also stop dividend reinvestments in stock funds and instead invest your earned dividends in bonds. You have to pay taxes on your dividend when you get them, so there’s not tax benefit of reinvesting them in stocks.

2. Sell stocks that have a capital loss.

The next option is selling stocks in your taxable account, especially at a loss. Selling your stocks with a current capital loss is great because you can use that loss to offset up to $3,000 in your taxes each year and the remaining loss can be banked to use as a loss in future years.

How to do with Vanguard: To do this with Vanguard Mutual Funds, go to transact > Sell > Select Shares (make sure your Cost Basis Method is Specific Identification (SpecID) > and choose the shares that show a loss.

With Vanguard ETFs, go to Transact > Sell> Choose Market > Cost basis: Specific Identification (SpecID) > Select Shares > and choose the shared with a loss.

As of Sept 2024, when I checked, none of by VTSAX shares had a loss. What a good problem to have! But, alas, I can’t harvest any capital loss in my rebalancing now. So we move on to the next step.

3. Sell stocks and buy bonds in a Traditional tax-advantaged account aka not a Roth.

If either of these strategies is insufficient to shift your allocation to the level of bonds you want, you need to rebalance. And you should rebalance your tax-advantaged accounts, prioritizing your Traditional (tax-deferred) accounts.

Why rebalance in your tax-advantaged accounts? So you don’t have to sell stocks at a capital gain in your taxable accounts and thus incur taxes on the sale.

Why rebalance in a Traditional account vs. a Roth?

You generally want to keep your assets with the highest growth potential (stocks) in a Roth. That’s because any growth will be tax free! So if you want to add more bonds to your portfolio, add them in a Traditional 401k or IRA, when possible.

But how do I access my bonds before age 59 if they are sitting in a retirement account!?

No problem.

I’m glad this follow-up question came up.

A couple of issues with that tho, 1.) equities growth wouldn't be tax sheltered. 2.) we are too young to withdraw from IRAs, so if the market tanks and we want to hold equities and sell bonds for a while, we can't. We can only sell equities from our taxable account to fund living expenses.

This gets at the heart of how you strategically allocate your retirement and non-retirement accounts portfolio.

It’s possible to, in essence, get access to bonds in a retirement account early by thinking about your portfolio across all accounts.

This person is worried about being able to sell bonds and access those bonds in an IRA before 59 and a half. While not strictly possible in the way they think about it, achieving the same outcome is possible if you think about your retirement and non-retirement accounts as a single portfolio!

To understand why, consider two hypothetical retired people younger than 59 and take two different approaches to selling bonds to cover living expenses when stocks are down.

Person A sells bonds in a retirement account:

Person A doesn’t have any bonds in their brokerage account. So he or she:

Sells equities at a loss in brokerage account for living expenses

Sells the same $ value of bonds in retirement account and uses that to buy equities in that same retirement account so they gain as much equities as they sell.

Person B sells bonds in a brokerage account:

Sells bonds in brokerage account for living expenses

Both cases have the same impact on their overall portfolio allocation. Both people have reduced their bond holdings and maintained their stock holdings.

What’s different in these examples? Taxes.

When stocks are down, you sell your equities at a loss in your brokerage account, which means a capital loss that you can write off your taxes up to $3k each year! Selling bonds in a brokerage account could lead to a capital gain if bonds are up at the time (but that depends on the exact situation). Generally, the tax impact is smaller because bond taxes are more generated by their interest than capital gain/losses.

What about when stocks are up?

When stocks are up, the situation is essentially reversed. But then again, the whole premise of this follow-up question is what to do when the market is down, and you need the money. That didn’t happen because stocks are up, and the worst-case sequence of return risk didn’t pay out. So your plan is on track and life is good.

What is 'optimal' depends on a lot of factors, not just this tax efficiency in the single year that we are talking about. But if your primary goal is risk mitigation by having bonds available when the market is down, it's better from a tax perspective in the short term for your bonds to be in your tax-advantaged retirement accounts.

What about sheltering equities from gains?

Should equities be in a brokerage account where the gains will be taxed?

This is a tradeoff question. And we have to return to the assumption we discussed at the start of this article that your taxes will be lower in the future than they are now.

Consider the alternative of keeping bonds in your taxable account to shelter equity gains in a tax-advantaged account. This is not tax efficient in the short term, because your are paying tax every year on bond income.

In a Traditional IRA/401k, you will still pay taxes on the equity gains when you withdraw, so that’s essentially the same as in a taxable account (with the minor benefit of not getting taxed each year on dividends).

It is indeed advantageous in put equities in a Roth IRA/401k account. And you should do that first, and then consider these other questions when deciding what to do with your taxable accounts.

I’ll get into a more comprehensive review of optimal asset allocation across all types or retirement accounts and taxable accounts in a post soon.