The 8 Core Truths of Investing

Adhere to these Core Truths and you can avoid mistakes and grow wealthy.

These Core Truths are distilled from the wisdom shared by the world’s best investors and financial thinkers, including Warren Buffett, Charlie Munger, Jack Bogle, and Morgan Housel.

First Principles

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” - Albert Einstein.

Let’s start with the first principles of investing and then discuss how to apply them to an investing strategy in our 8 Core Truths.

Compounding. Compound interest is the primary mechanism of wealth accumulation. To let it work its magic, we need to 1) be invested, 2) not interrupt it, and 3) let it work over a long time frame.

Risk-reward. There is a risk-reward tradeoff in investing. Higher returns generally come with higher volatility and risk.

What we can control. Much of what affects our investment returns is outside our control, but enough is within our control to succeed in the long term. Focus on what you can control—your decisions, reactions, and actions (or, equally important, your non-actions).

Psychology. Emotions drive the lion’s share of our decisions. This was the key insight of Behavioral Economics. In investing, emotional decisions often make us poorer by interrupting compounding, keeping us out of the market, or distracting us with things we can’t control. We must manage emotions and behavior intentionally.

The following Core Truths are time-tested frameworks that will help every investor make informed decisions to grow their wealth.

1. The stock market is unbeaten over the long term.

“Compounding is a miracle. So, even the modest investments made in one’s early 20s are likely to grow into staggering amounts over the course of an investment lifetime”- John Bogle.

The US stock market boasts an impressive record of generating wealth over a person’s lifetime. Since 1926, there has never been a 20-year period of negative returns.

The fact that the long-term stock market return has been positive is not coincidental or a fluke of luck.

It’s an outcome of the well-understood economic fact that businesses are an engine of economic growth. This is why the stock market tends to go up.

Of course, the stock market can fluctuate up, down, or sideways in shorter time frames.

Sometimes, the market goes down in concerning amounts. In these moments, we may wonder if this time is different. This time, the market won’t go back up.

Of course, there is no guarantee that the stock market will always go up.

However, throughout modern history, wise investors who have followed their plans and remained invested when the market has dropped have grown wealthier than those who have not.

The excellent Ben Carlson illustrated the relationship between the longer you wait and the certainty of making money in the stock market.

2. Risk of Ruin is enemy #1.

"The first rule of compounding is to never interrupt it unnecessarily." - Charlie Munger.

Be ever wary of the Risk of Ruin.

The Risk of Ruin is losing so much that you can’t stay invested.

The magic of compounding depends on staying in the game over the long term. Compounding is about longevity.

Significant losses interrupt this compounding process, which can erase years of gains and essentially restart the clock.

Making up losses becomes increasingly challenging as you approach zero. A 50% loss requires a 100% gain to recover, and a 90% loss requires a 1,000% gain!

The deeper the loss, the harder it becomes to recover. Avoiding Ruin ensures you never reach this tipping point where recovery becomes nearly impossible.

For this reason, most investors should:

Approach with caution anything that could involve losing most or all of your money. This includes leverage, options, and speculative assets. Do not allocate large parts of your portfolio to these strategies.

Build a margin of safety into your financial plan and investing strategy, even if it means sacrificing some expected returns.

Ensure you are covered for other life events that could put you out of the game. This includes life insurance, disability insurance, umbrella insurance, and an appropriate emergency fund.

That’s not to say you can’t make mistakes. It’s OK to make mistakes as an investor. Every single investor has made some errors and missteps. They can be painful, but they can also be valuable learning opportunities.

What you need to avoid is catastrophic mistakes that could ruin you.

You will continue to make progress as long as you can stay invested long-term. And progress beats perfection.

3. Time in the market beats timing the market.

“Invest you must. The biggest risk is the long-term risk of not putting your money to work. Never think you know more than the market does. You're apt to be wrong if you do.” - Jack Bogle.

We have to be invested in the market to earn anything!

Waiting on the sidelines has a huge opportunity cost. Rather than wait to “buy the dip,” you are better off getting any money invested in the market quickly.

Why? Studies show that missing the best-performing days in the market significantly impacts long-term returns.

In the 20 years up to 2020, if you stayed fully invested in the S&P 500, your annualized return was around +6.06%.

Missing just the 10 best days dropped that return to +2.44%, and missing the top 20 days left you with a measly +0.06%!

That loss of return is what you are risking by waiting for the “right time” to invest.

“All-time highs” are not as scary as they seem.

The fact that a market is at an all-time high is not a good reason not to invest. The truth is that all-time highs occur frequently when the stock market is on a bull run.

Consider this chart of the 2010s decade. The red dots show that the S&P500 hit an all-time high in over 200 days!

If you had found yourself looking at the first all-time high of the decade in 2013 and decided to wait to invest until a ~10% dip, you would have missed all of the gains of 2013 and 2014, sat out even longer, and missed a decade of solid growth.

4. It’s not about who earns more, but who invests more.

“Do not save what is left after spending; instead spend what is left after saving.”

There’s no way around living below your means. You cannot earn your way out of overspending. Just take a look at any celebrity who has gone bankrupt.

Increasing your savings rate is the single most important thing you can do to accelerate your financial freedom. The more money you save and invest, the more your future expenses can be covered with investment returns.

Many people focus solely on getting raises and increasing their earnings. Earning more is great. After all, there’s no limit to how much more you can earn, but there is a limit to how much you can save.

Many people don’t realize that if you earn more without increasing your savings rate in percentage terms, you are counterintuitively pushing the goal of financial freedom further away.

That’s because you are increasing your lifestyle expenses without increasing the amount you are saving.

Make sure you pay yourself first and ensure that your savings rate matches your long-term financial goals.

Fortunately, there are strategies and options available to boost your savings rate without compromising your lifestyle.

Notably, minimizing your taxes and reducing investment fees can be two of the best tools in your toolbox because they help you keep more of your money without having to earn more or spend less.

5. Uncertainty and volatility are the price you pay for higher returns.

“The volatility/uncertainty fee—the price of returns—is the cost of admission to get returns greater than low-fee parks like cash and bonds. The trick is convincing yourself that the market’s fee is worth it. That’s the only way to properly deal with volatility and uncertainty—not just putting up with it, but realizing that it’s an admission fee worth paying.” Morgan Housel, The Psychology of Money

There’s no way around it. Higher returns mean more risk, uncertainty, and volatility.

Inevitably, the market will experience a downturn or a complete crash. Watching your hard-earned money evaporate is stressful, frustrating, and anxiety-inducing.

So what should we do in the face of this?

Two things -

Commit to staying the course. The best thing you can do is keep following your plan. Remember that the stock market has been reliably positive over 20-year timelines (see #1).

Ignore the noise as much as possible.

There’s little value in checking your portfolio often or reading daily market news and market predictions.

Take predictions - An expert telling us what to expect seems helpful, right? It turns out, no, not really.

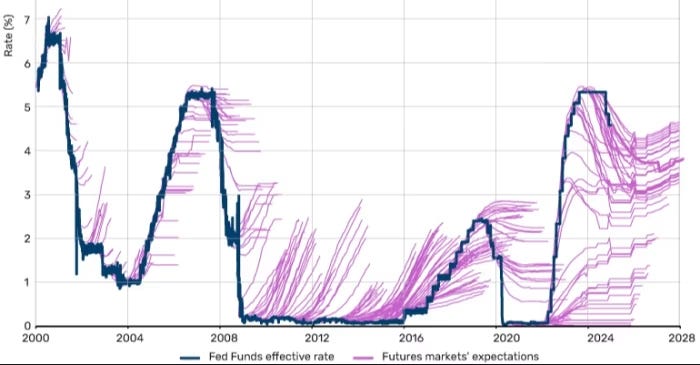

Most short-term predictions are wrong and rarely prove useful. For example, consider the chart below from the Financial Times, which shows the actual Federal Funds interest rate compared to predictions.

Sometimes, the market and experts predict the direction of the change correctly; other times, they do not. However, they never accurately predict the change's magnitude and timing, making them useless for the typical individual investor.

6. Understand your investment game. Don’t follow advice from people who play a different game.

“A takeaway here is that few things matter more with money than understanding your time horizon and not being persuaded by the actions and behaviors of people playing different games than you are. The main thing I can recommend is going out of your way to identify what game you’re playing.” - Morgan Housel, The Psychology of Money.

My focus is on individual investors who are investing for the long term. That’s one particular investing game.

But it’s not the only one. There’s also the investing game of day trading, the game of options trading, the fix-and-flip real estate investor game, and many more.

Although it may not be immediately obvious to a new investor, these games have different rules, goals, and strategies.

Most importantly, they all have different timelines.

You don’t need a stock to be a great company if you are a day trader. You just need the price to go up tomorrow.

The opposite is true if you are a long-term investor - the stock doesn’t need to go up tomorrow. It simply needs to be a great company that achieves long-term success.

Many investors have lost their shirts by following the advice of someone playing one game while they were actually playing another. And they didn’t even realize the two games were different.

Understand the game you are playing and think carefully about any decision or advice through the filter of the game you are actually playing.

7. The best investment strategy is the one that lets you sleep easy.

If your portfolio is too aggressive, the stress of market fluctuations increases the odds that you will make emotional and poor decisions, such as selling during a downturn.

Conversely, if your allocation is too conservative, you risk missing out on the long-term growth needed to reach your goals.

The investment strategy that allows you to stay committed to your plan is far better than the "optimal" one you abandon under stress, as it enables you to stay in the game for the long term.

The market shines on those who can stick it out (see #1).

When setting your portfolio allocation, consider how much your portfolio would have lost during the Great Recession. Are you comfortable with that? Are you sure you could sleep OK while a downturn like that is underway? If not, make it more conservative.

If you haven’t gone through a stock market downturn yet, consider adding a margin of safety of an additional 5-10% of conservative assets beyond what you think helps you sleep well.

This margin of safety gives you an insurance policy that you can stay the course when volatility happens (see #5)

8. A plan must have an exit strategy.

A good exit strategy has an identifiable finish line and clearly outlines what will happen when you reach it. It helps you plan for the endgame.

Unfortunately, much financial advice focuses on initial actions while overlooking subsequent ones.

Most investment advice I read, even from major media outlets, fails this test. I often come across the advice, “Buy XYZ stock; it’s positioned to grow!”

Let’s say I follow that advice. Okay, I bought it. Now what? How long should I hold it? When should I sell it? What should I do with the money after I sell it?

Most non-professional day traders operate this way, and their exit strategy is to basically ‘figure out what to do later after I make lots of money.’ (Not coincidentally, this is how most gamblers at the blackjack table operate.)

A plan with an exit strategy would be: I will buy a ZYX stock fund and hold it until I have $2.5M, at which point I will withdraw $100k per year to live on.

If you don’t have a plan for what you will do at the end, you will not know when you get there, much less what to do.

That’s not to say you can’t update the exit strategy with new information. Sometimes, you should. But if you don’t start with a plan, you will flail around and make worse decisions.

Bonuses: Investing-adjacent Truths

Money + Health = Freedom.

Money and health affect everyone on this planet. Together, they give people true freedom.

Freedom is the end goal. I like Morgan Housel’s definition: “The ability to do what you want, when you want, with who you want, for as long as you want, is priceless. It is the highest dividend money pays.”

I’d argue that this is the goal of investing. It’s not status, not a measuring stick for success, not just because you “should.”

Keep that in mind as you are designing your life.

Remember the other half of the equation: health. Health is finite and precious, so avoid sacrificing it for money.

Choose your spouse well.

Like most things, investing is best played as a team sport. Find a life partner who aligns with your values and goals. The right partner can serve as a support system as you both develop and implement your investing strategy, ultimately helping you design the life you want to live.

This is probably more important than anything else on this list. Money can be stressful, and divorce is expensive, so it's crucial to find the right person to enjoy life's journey.

What’s your core investing truth? Share it in the comments!