The Best S&P 500 Fund for Long-Term Investors

How to pick the cheapest, cleanest, and most reliable S&P 500 ETF.

Have you decided you want to invest in the S&P 500, but not sure which ETF to use?

Don’t waste hours comparing funds. Today, I’m going to share my pick for the fund that makes the most sense for long-term investors.

But first…

Should you choose and S&P 500 fund or Total Market Fund?

I wrote last week that I prefer total market funds, particularly VTI. But some people have said they would still like to just buy the S&P 500. In fairness, I think a low-cost S&P 500 ETF is still an excellent long-term plan. So, if that’s what you’re set on, you’re not making a mistake. After all, getting started investing is much more important than quibbling about minor differences in portfolio strategy.

What’s the difference?

A Total Stock Market Fund, like my favorite VTI, owns almost the entire US stock market: it owns the entire S&P 500 plus mid and small-cap stocks. That’s roughly 3,500 companies.

S&P 500 funds own only the largest 500 US companies.

What are you missing by choosing the S&P 500? You’re missing mid- and small-cap stocks, which historically provide modest diversification and slightly lower risk.

Why might you still choose and S&P 500? You want to invest in only the largest, more stable companies in the USA. After all, they have slightly over performed the total market over the last decade.

For most long-term investors, both approaches work well, but only if you follow a few strategic principles:

Keep fees ultra low

Diversify

Hold for the long-term.

Match to your risk tolerance and timelines.

The Four Main S&P 500 ETFs

Four ETFs dominate the S&P 500 space:

VOO. Vanguard S&P 500 ETF, launched in 2010. Low fee, clean structure, and the perennial community favorite because it is operated by Vanguard, the most trusted investment company out there.

IVV. BlackRock iShares Core S&P 500 ETF. Launched in 2000, it is low-fee and nearly identical to VOO in every practical way.

SPYM (recently changed from SPLG). State Street’s SPDR low-cost S&P 500 ETF. The lowest expense ratio of the bunch, but less popular and somewhat smaller than VOO or IVV.

SPY. State Street’s SPDR S&P 500 ETF Trust is the original S&P 500 ETF, launched in 1993. Massive trading volume but slightly higher fees. It has a unique fund structure that makes it suited for frequent traders (which isn’t important for us long-term investors).

Choosing the Best. What “Best” Means

For us investors who want to build life-changing long-term wealth. “Best” doesn’t mean “had the highest return last year.” It doesn’t mean what’s the trend of the day. It means focusing on what matters.

What matters

Ultra-low expense ratio (ideally under 0.05%). Because lower fees = higher returns.

Tracks the S&P 500 index reliably.

Simple, rules-based, buy-and-hold friendly.

Tax-efficient, especially in taxable accounts.

Easy to trade at common US brokers.

What does NOT matter much:

Tiny performance differences (0.01% variance)

Trading features aimed at day traders

Marketing hype

With that framework in mind, let’s compare these four options.

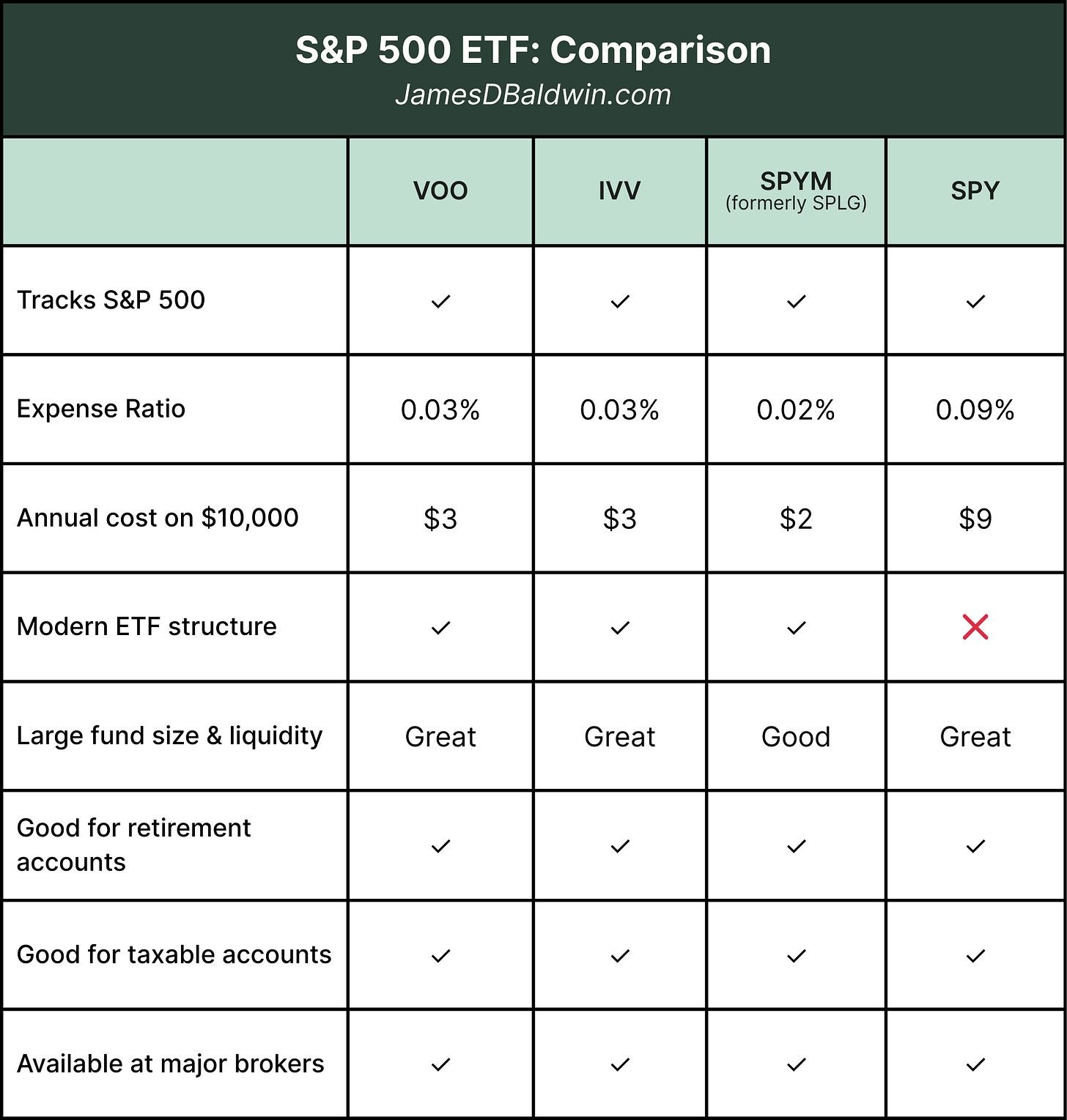

Comparison Table: What to know about each

Here’s how they stack up:

Comparison Summary:

All four are solid index funds that will get the job done. IVV, VOO, and SPYM(SPLG) look almost identical for long-term buy-and-hold investors.

SPY costs three times as much (0.09% vs 0.03%) and uses an older fund structure that matters more to day traders than to investors. If you’re investing $10,000, the difference between VOO and SPY is $6 per year, not life-changing, but why pay extra?

How to Pick the Right Fund

Step 1: Check what your accounts offer

In 401(k)s, use the low-cost S&P 500 index option available. You usually won’t have a choice between these specific ETFs anyway.

In taxable or IRA accounts at any major brokerage, you’ll have commission-free access to all of these ETFs. If your current broker still charges commissions, that’s a sign you should switch to a modern, low-cost platform like Fidelity, Schwab, or Vanguard.

Step 2: Pick one cheap, modern ETF and stick with it

Here’s my recommendation:

Use VOO as the Default Choice. Vanguard is the gold standard for index investing. Jack Bogle, the inventor of index funds, literally founded it. VOO has a 0.03% expense ratio, strong performance tracking, and it’s the fund I would pick.

Use IVV if it makes more sense for your situation. BlackRock’s iShares IVV is equally good: same 0.03% expense ratio, same modern structure, same reliable tracking. Choose IVV if your broker offers commission-free trades on IVV but not VOO, or if your employer retirement plan includes IVV.

SPYM(SPLG) is also fine. It has the lowest expense ratio at 0.02%, saving you $1 per year on every $10,000 invested compared to VOO. If you are trying to squeeze out every penny and ok with a slightly smaller fund, it’s still perfectly fine.

SPY is not a top choice unless you already own it or if it’s the only option in your plan. I wouldn’t start fresh with it today, given the higher fee.

Step 3: Automate and stop comparing

Set up automatic contributions. Focus on your savings rate and staying invested through market ups and downs, and don’t worry about re-shopping tickers every year because you know you have chosen one of the largest and lowest cost funds available.

What if you already own another fund?

If you already hold a low-cost S&P 500 ETF in a taxable account with gains, switching funds to save <0.1% in fees usually isn’t worth triggering a taxable event. Stick with what you have.

If you are currently using a high-fee fund. For example, >0.2% Move all your new contributions to one of these low-fee options, rather than sell your existing fund to avoid capital gains tax. You can wait until the market goes down and you have a loss to move the money. Make sure you select MinTax as your cost basis method. To learn how to manage investment taxes, see here.

The Bottom Line

My default recommendation is still a total market fund like Vanguard’s VTI, but a low-cost S&P 500 ETF is also a great long-term plan. The difference is small enough that you won’t regret either choice in 30 years.

My answer: Pick VOO. If IVV is commission-free for you and VOO isn’t, pick IVV instead. Invest consistently, ignore the noise, and let compound growth do its work.

That’s it. Now get started, automate it, and start building life-changing wealth!

I’d love to hear from you: Which fund did you choose? What investing topic should I cover next? Drop a comment below.

Disclaimer: This article is for general education only. It isn’t personal financial advice. I don’t know your whole situation, goals, or risk tolerance, and nothing here should guide your decisions on its own. Do your own research or speak with a professional before acting on any investment ideas.

SPLG is now called SPYM.

Excellent breakdown of the best four S&P 500 choices.