The 10 Steps to Life Changing Wealth.

[Updated January 2026] A clear framework to cover your financial bases in the right order.

Financial advice is everywhere: invest here, pay off that, buy this.

Wealth doesn’t come from chasing random ideas. It comes from doing the right things in the right order.

This guide lays out the 10 steps that matter most, in the sequence that works best.

Just the steps one at a time. ✅

A few general principles to keep in mind

Align with your partner: Couples make the most progress when they work toward a shared vision. Talk about financial goals and challenges. If one of you is a spender and the other a saver, treat those differences as strengths. Used well, they create balance and better decisions over time.

Give generously: Contribute to your community through time, money, or action. Focus on what you can give now; abundance builds happiness, networks, and long-term wealth.

Invest wisely: Favor diversified, low-cost index funds for reliable long-term growth, like this one. Real estate and other active investments should wait until step 9+, after you have a strong foundation.

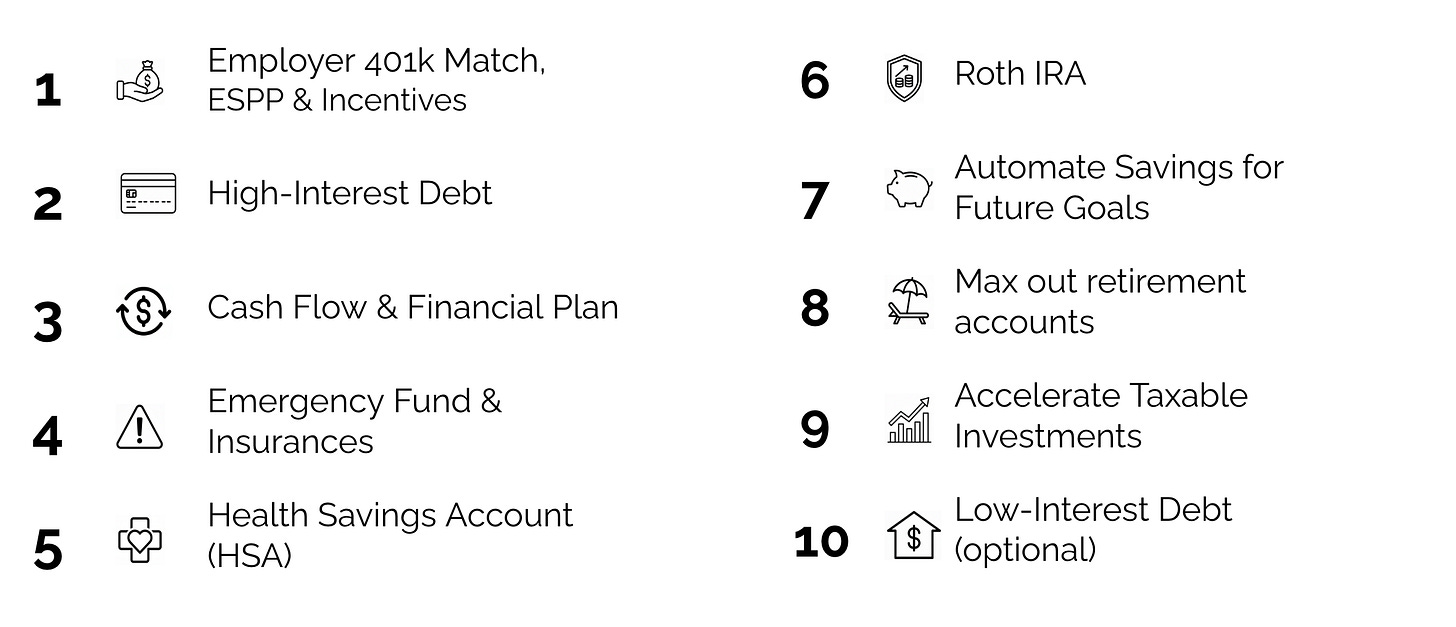

The 10 Steps to Wealth

1. Get your employer match.

There’s no easier free money than an employer match for 401(k) or 403(b).

Not all jobs offer a match, but if yours does, take advantage of it before anything else, even before paying down credit card debt.

If your employer offers a discounted stock purchase plan, include it in this step.

What if I don’t know what to invest in?

If you’re unsure what to invest in, choose a Target Date Fund like Fidelity’s “Freedom Funds” or BlackRock’s “Life Path” funds. Most 401(k)s will offer one.

These funds automatically hold a diversified mix of stocks and bonds, adjust risk as you age, and rebalance over time. They’re designed to do the hard work for you at low cost. Pick the fund with the year closest to your expected retirement date.

If your plan doesn’t offer a Target Date Fund, use a simple three-fund portfolio with the lowest-cost options available.

2. Pay down high-interest debt.

Process note: I recommend doing this step and the next one simultaneously. They reinforce each other.

High-interest debt includes credit cards, payday loans, and personal loans. As a general rule, rates above 7% are high-interest.

Every dollar of principal you pay down means less interest charged to you next month. Do whatever you can to aggressively pay off more of the principal each month.

Which debt should I pay off first?

From a financial standpoint, paying off the highest-interest debt is best.

If motivation matters more to you, paying off the smallest balance first can help build momentum. Choose the approach you can actually stick with.

3. Track spending without micromanaging it.

Detailed budgets don’t work for most people. Life is too variable, and strict categories often create stress without helping you control spending. They certainly never worked for me.

Tracking your spending, on the other hand, does work. It tells you exactly how your money is being put to use. It gives you important data to make future decisions.

“What gets measured gets managed” - Peter Drucker

Use a tool that automatically categorizes spending so you can focus on the big picture, not every dollar. Empower or Monarch Money are good options.

After a month or two, check your spending:

Are your fixed costs <60% of your take-home (housing, bills, groceries, car, gas)

Are you saving and investing something each month? The goal is to grow this over time to >15%.

Everything else is fun money. Do whatever you want with it!

Understanding is enough to help you start thinking differently and naturally make decisions that make sense without feeling like you are sacrificing.

You may also spot areas where money is leaking out. Are you paying for a subscription you no longer use? Did your insurance go up and it’s time to shop around? Are there monthly bank fees you could avoid?

4. Protect yourself.

4a. Start building a right-sized Emergency Fund.

A common guideline is 3–6 months of essential expenses. That’s a good range for most people.

If you have a single income, dependents, or high fixed costs, you may need more. If you have two stable incomes and lower fixed expenses, you may need less.

When in doubt, aim for six months. Keep this money in a high-yield savings account where it’s safe and accessible.

4b. Add any missing insurances.

Beyond the insurance most people already have through work or legal requirements, there are a few additional policies worth considering. Your employer may already provide coverage.

Life insurance: Term life insurance is usually the most cost-effective to help replace earnings if something happens to you.

Disability insurance: Long-term disability insurance is especially important for high earners with families who depend heavily on their paychecks.

Umbrella insurance (optional): Provides an extra layer of liability protection on top of your home and auto insurance. Particularly valuable if you have high assets or earning potential.

5. Invest In Your HSA.

ADVANCED STRATEGY: This step requires more diligence and the ability to pay healthcare costs out of pocket. If that’s not feasible, skip to Step 6.

HSAs are one of the most powerful investment accounts available if you use an uncommon strategy.

In an HSA, contributions are tax-deductible, investments grow tax-free, and withdrawals for medical expenses are tax-free. No other account offers all three tax advantages. Smart tax strategy is often what differentiates people who build serious wealth.

Turning an HSA into an investment account.

If you can afford to pay medical expenses out of pocket, then invest the HSA funds in the market until you retire, it effectively becomes another retirement account. Then, you can reimburse yourself for medical expenses at any time in the future, including in old age when you will need it.

How much is too much in an HSA?

There’s little downside to saving large amounts in an HSA. Even if you save more than what you need to pay for medical expenses in retirement, HSAs also allow you to withdraw money from them for regular retirement expenses.

Continue on to Part 2.

These steps are about getting the most important things done first so you build wealth as simply and quickly as possible.

In Part 2, we build on this foundation by accelerating savings, optimizing taxes, and growing wealth more efficiently over time.

Roth IRA accounts.

Automating savings for future goals.

Maximizing your 401(k) or 403(b).

Minimizing taxes.

Accelerating wealth growth in taxable investments.

Paying off low-interest debt.

Disclaimer: This article is for general education only. It isn’t personal financial advice. I don’t know your full situation, goals, or risk tolerance, and nothing here should guide your decisions on its own. Do your own research or speak with a licensed professional before acting on any investment ideas.

Ready for part 2!

Super helpful! Eagerly waiting for part 2!