The 10 Steps to Life Changing Wealth. Part 2

The only 10 steps you need to cover all of your financial bases. Part 2.

If you haven’t read Part 1 yet, start there and work through those steps before moving on to the steps here.

A few general principles to keep in mind - Part 2

In Part 1, we covered a few principles, all of which still apply. Plus, we are adding a few more. From Part 1:

Stay aligned with your spouse.

Always be generous.

Passive Investing is the way.

Personal finance is personal: The core steps work for everyone, but how you apply them should match your income, lifestyle, goals, and timeline.

Automate once, then maintain: A little effort upfront sets your systems to run automatically, so you only need to check in occasionally.

Start small and get creative: If you are wondering how you can free up money each month to move onto the next step, return to step 3: Track Your Money. Look for ways to creatively reducing waste, using raises and credit card rewards strategically, and negotiating to increase your income.

Now, on to Part 2 of the 10 Steps.

6. Contribute maximum to Roth or backdoor Roth IRA.

Roth IRAs are the second-best retirement account after HSAs for most people. Your money grows tax-free and is tax-free when withdrawn. Once you put money in a Roth, it is never taxed again. Anyone who makes less than the IRS’s income limit can open an IRA at their favorite investing platform and start contributing. Then set up automatic investments to contribute to the maximum limit each year.

If you are unsure what to invest in, start with a Target Date Fund (TDF) that matches the year you expect to retire. See Step 1 for more info on TDF’s. You can find Vanguard’s options here.

What if my income is too high to contribute to a Roth IRA?

Higher earners often assume they can’t use this strategy because of the income limit. But there’s an entirely legal way around the limit. If you make more, you can still access a Roth IRA through the Backdoor Roth IRA strategy.

To do so, you contribute to a traditional IRA through a brokerage like Vanguard. These have no income limits for contributions. Then, you tell your brokerage to convert this traditional IRA to a Roth IRA. There’s also no income limit to convert. Here is my guide to every step of the Backdoor Roth IRA process and how to avoid mistakes.

When you do the Backdoor Roth, you'll pay taxes on any pre-tax contributions and earnings at the time of conversion, but these are just the regular taxes you pay on your income. There’s no extra tax. And after that, your money grows tax-free throughout your life. No capital gains tax, no tax on dividends!

There is a wrinkle that you need to be aware of. You could get taxed through the "pro-rata" rule if you have any other open traditional IRA accounts. You can prevent this by moving any of your traditional IRAs into your 401(k) (your 401(k) plan has to allow this, so call them to ask about the process first)

7. Automate savings for future goals

Take a moment to think about what you want to save for. Your next car, perhaps? An annual vacation? A house downpayment? List the top 3-5 things you want to start saving for.

The next step is to set up automated savings to achieve those goals. Automated saving is better for wealth building than manually transferring money every once in a while for a bunch of reasons:

You never forget, which means more time spent in the market or a savings account, earning more money.

You automatically Dollar-Cost Average (DCA). You buy more investments when prices are low and less when they are high.

You are less tempted to make emotional decisions or time the market because it’s happening without you having to decide each time.

It takes WAY less work. We all live busy lives. Between work, travel, and everything else you have going on, it feels good to have one part of your life that takes care of itself.

Starting with a minimal amount is fine; you can increase the automatic amounts as your income grows. Just get started.

Most banks and investment platforms make setting up automatic transfers simple. You’ll need to link your savings account to your checking account to set up an automated transfer at least once a month. I automate mine a day or two after my paycheck is deposited. If you prefer, ask your company's payroll department to deposit part of your paycheck into your savings account automatically. Most payroll companies can split your paycheck.

For an added behavioral nudge, split your savings accounts into sub-accounts and give each a nickname on your bank's online platform. Many savings accounts can do that today. For example, naming them “House Down Payment Fund” or “Future Kid’s Education” makes them more meaningful and helps prevent you from dipping in for other things.

Then sit back and let time work in your favor as your savings goals fall into place.

What type of account should you use to automate saving?

High-Yield Savings Accounts (HYSA) are the best option for short- and medium-term savings goals, so use the same bank where you keep your emergency fund and add additional savings accounts to it. Here’s a list of some of the highest-interest accounts available right now.

What about savings for kids’ education? Shouldn’t I do it earlier in the steps?

While it may be surprising, this is the right step to start saving children’s education, not before. You want to establish your own financial foundation before you begin saving for your kid's education for a few reasons:

The greatest gift you can give your child is not to be a financial burden later in life. By focusing on building your retirement fund now, you let the miracle of compounding returns help you build financial security for all of your family down the road.

There are no retirement loans like there are for education. Education loans tend to have lower interest rates and can help cover any gap if you can’t save the entire cost in time.

A “529 Plan” account can be a better option when saving for education than a High Yield Savings Account. A 529 plan is a tax-advantaged savings account designed specifically for education expenses, where the money grows tax-free and can be withdrawn tax-free if used for qualified education expenses.

How much should I be saving before moving on to Step 8?

Step 8 is where you grow your retirement contributions, and it is very important. I recommend that you don’t save too much for shorter-term goals at the expense of your retirement.

I advise saving only 5% of your gross income in this step. Once you’ve hit that, then move on to step 8. After you’ve accomplished step 8 and are saving at least 15% for retirement, you can decide whether to A.) keep increasing your retirement saving rate to retire sooner or B.) return to this step and increase your short- and medium-term savings for future expenses you expect. That’s entirely up to you.

Is this when I should buy a house?

Buying a house, like starting a family or moving to a new city, is a life decision with financial implications. It's not a financial decision with life implications. That’s why we don’t have them as a single step here.

However, generally speaking, this is when you can now start saving for a down payment, so buying a house tends to happen around this step or one of the following steps.

To know if you are ready to buy a house, here’s my general criteria:

You are confident you will stay in it for 5-7 years. The closing and moving costs, plus the risk of short-term price fluctuations, make it generally a bad decision to buy if you think you may move again in less than 5 years.

You can save at least 15% for retirement after buying the house.

You can save at least 5% for your short-term financial goals.

You want to buy a house and are ready to deal with maintenance, property taxes, and the other downsides and nonsense that come with it.

You do not have to buy a house to grow wealth.

Renting as a long-term strategy could be a better financial decision than buying, especially for people living in areas with high property values relative to their income.

If you want to buy a house, that’s fine. But if you don’t, that’s also fine. Don’t feel like you must own property to grow your wealth.

You may be better off renting for the foreseeable future. The New York Times has an excellent calculator to help you decide whether renting or buying is financially better.

8. Contribute the maximum to 401(k) or 403(b).

Now, you can increase your contribution to your 401(k) or 403b retirement plans. You may need to increase your income to contribute the maximum, as the annual contribution limit is a significant amount.

How much retirement savings is good enough if you can’t get to the max?

It depends on how soon you want to retire.

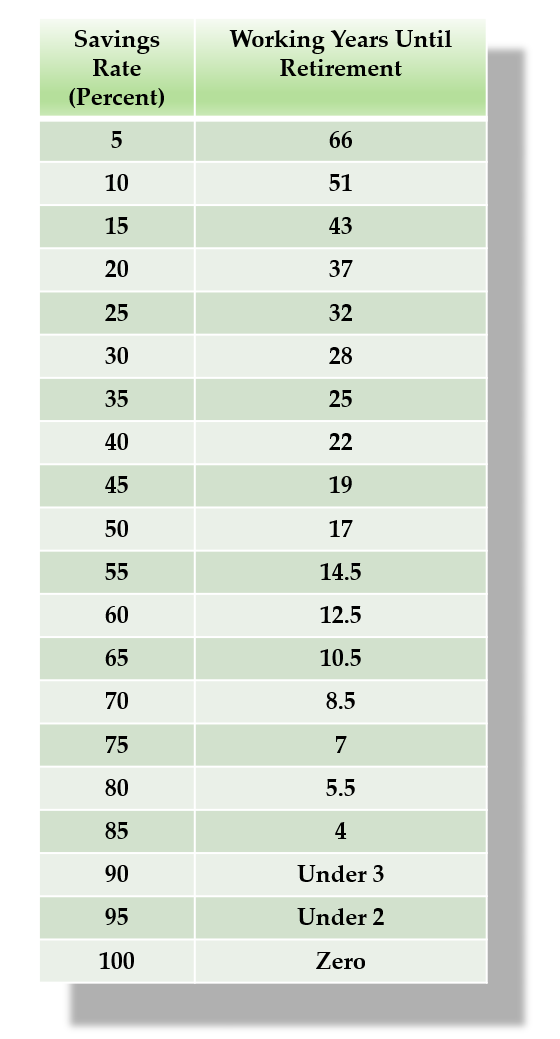

Your retirement savings rate is what determines this. Your retirement savings rate is the percentage of your gross income you save and invest for retirement across all accounts, not just a 401(k).

A general rule is that you should save and invest at least 15% of your income for retirement if you want to retire after about 40 years of working and saving. That’s the equivalent of someone who started working in their early 20s could retire in their early to mid-60s.

If you want to retire sooner than that, you need to increase your savings rate percentage.

Based on your savings rate, Mr. Money Mustache has a great table of how many years you need to work before you can retire. It assumes you are starting with $0 in savings and that your savings are invested, earning a 5% return after inflation.

Look at the left column for how much of your income you are saving, then at the right column, which will tell you how many years you will have to work. Or vice versa if you want to work backward to determine how much to save based on how many years you want to work.

You can see that a 15% savings rate means you have to work for about 43 years. That’s the equivalent of working from age 22 to 65.

Increasing your savings rate from 15% to 20% will decrease the number of working years to 37, cutting 6 years off!

Working backward, what if you only want to work for 20 years? Then, you need to get your savings rate up to 40-45%.

What kind of life do you want?

Ultimately, this decision about how much to save for retirement depends on how you want to live your life.

Some people in the Financial Independence/Early Retirement movement become obsessed with increasing their savings rate, making sacrifices that lead them to miss out on enjoying their life in their working years.

I think that’s going too far. Your working years are when you tend to be the healthiest and have the strongest social network. Take advantage of getting out there and having fun with the people you care about! Remember, some of us sadly don’t make it to retirement.

Of course, you can go too far to the opposite side of the spectrum.

I continually see questions that are some version of “I’m burned out. My work is grinding me down, and I can’t keep doing it. I only have $X saved. Can I retire?”

Burnout is affecting so many of us these days. If you are in a role with pressure or stress, don’t assume you’ll want to do it for most of your life, even if you like your work now. Make sure your savings rate is high enough to retire a little early if your priorities change.

In short, hedge your bets. Don’t live ultra-frugally and deny yourself the fun parts of life when you are young, but save and invest enough so you have an early-exit strategy if you need it.

How much is too much to invest in a retirement account vs. investing in a taxable account?

If you plan to retire in your 60s or later, it’s hard to have too much because you will be using these funds for all your living expenses, including some costs that may go up in retirement, like health costs, long-term care, travel, etc.

But if you plan to retire before age 59.5, this question is more complicated.

There are strategies to access some of your funds from your 401(k) and IRA before then, such as for home purchases, through a Roth conversion ladder, or Substantially Equal Periodic Payments (SEPP). But despite these strategies, you will likely want to have some portion of your retirement in the taxable investment step below, accessible at any time.

If you are working toward a very aggressive retirement age of, say, in your 40s, you should prioritize at least 5-10 years of expenses in your taxable accounts and potentially more.

An early retirement is entirely doable (and what I am planning for), but requires you to run the numbers and plan carefully. Some tools can help you with this, like Projection Lab, or you can get advice from a financial professional.

What if I have a pension?

The table above does not apply to those with a pension. Increasing your savings and investment rate can allow you to retire earlier. However, earlier retirement can come with reduced pension income, so you must understand how to calculate your pension amounts and run the numbers based on your goals.

9. Accelerate wealth growth with taxable investments.

When investing more than 15% for retirement and meeting your goals to save for future expenses, you are now in a position to accelerate wealth growth. If you intend to retire after 60, this is optional.

If you want to retire before 60, you should invest significantly in your taxable investments.

Since you already have a Roth IRA, opening a brokerage account with the same company is often the simplest option. I’m a fan of simplifying your accounts wherever you can. Having multiple brokerage accounts can be a hassle. I use Vanguard for both IRAs and taxable brokerage accounts.

In this step, you set up automated investments to diversified index funds and slowly build that amount up to your savings rate target over time. Target Date Funds are still a good option, as are total market stock and bond index funds.

How much is enough? How much is too much?

It depends on when you want to retire. The same principle applies as we talked about in Step 8. Look at the table above to help you set a target for your savings rate based on when you want to retire.

Tax-loss harvesting: Annually (optional)

Tax loss harvesting is a way to reduce your taxes by selling investments that have dropped in value, which creates a “loss” you can use to offset gains from other investments and reduce your tax bill.

Each year, look for assets in your taxable account that have dropped. You must look at individual tax “lots” to see which have gone down. Tax “lots” are essentially each batch of an investment you purchased simultaneously. If you have lots that have gone down, you can sell them and buy a different but similar investment to keep your money working without breaking IRS rules about buying back the same investment within 30 days.

10. Pay off low-interest debt early (optional).

Some of us will never feel truly financially free if we have debt.

If that is you and it’s low-interest debt, like a mortgage or anything less than <7%, it’s up to you whether you want to pay it off.

Some general rules for low-interest debt that I follow –

If it’s in the 5-7% range, my bias is towards paying it off when I have extra cash.

It’s below 5%; my bias is against paying it off as long as I meet my savings and investing goals. That’s because I will likely earn more in the market than I ‘earn’ by avoiding interest on the debt.

But that’s a personal choice, and there’s no wrong answer. Do whatever makes you sleep better at night.

You did it. Seriously.

Part 2 concludes the fundamental strategies of money management that apply to everyone.

If you’ve accomplished all of them, you are doing everything that matters most and ahead of 95% of the people out there. It’s an incredible accomplishment. So buy yourself a bottle of champagne or something new you’ve wanted. Seriously, you are doing it. Celebrate it.

We hope these 10 steps helped you cut through the noise of financial advice and grow your wealth. We love getting your questions, so please email or comment.

Is there anything more I should be doing?

We will discuss ways on this blog to squeeze more out of your hard-earned money and provide advice on building your financial plan.

We’ll get into more money management, investing, reducing taxes, and retirement planning. Subscribe and stay tuned.