The easiest way to become a 401(k) millionaire.

Giving your 401(k) a raise each time you get a raise is the easiest way to be a multi-millionaire in retirement without cutting spending or changing your lifestyle.

You can easily become a millionaire by the time you retire. Even a multi-millionaire. And you don’t have to spend less, budget harder, or change your lifestyle.

This is one of my favorite tactics and takes about 5 minutes to implement: Give your 401(k) a raise.

Every time your salary goes up, increase your 401(k) contribution by 1%. Or if you get a substantial raise, give half of it to your 401(k).

If you got your annual raise in January, now is the perfect time to do this before you get used to the higher paycheck.

Why the 401(k) Raise Works

There are many benefits to giving your 401(k) a raise, with very few downsides.

You invest more and spend more. Your take-home pay still goes up. You’re not sacrificing anything or cutting back. You don’t have to budget or track spending.

It blocks lifestyle creep. Instead of your spending rising to match your income, your investments rise first. You pay yourself first, before you can spend it.

It’s automatic. Once you increase the percentage, it comes out of your paycheck without you having to think about it or manage it.

Save on taxes. If you have a traditional 401(k) like most people, part of your raise doesn’t get taxed immediately. The money goes straight into your account pre-tax. (It will be taxed when you withdraw it in retirement, ideally at a lower rate.)

How To Give Your 401(k) A Raise

This should take you 5 minutes.

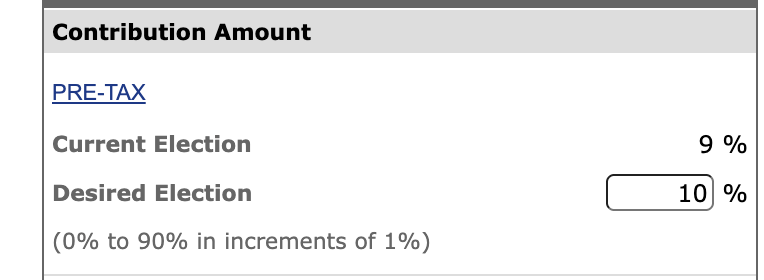

Log into your 401(k) portal

Find “contribution rate” or “deferral percentage.”

Increase it by 1% (or whatever you would like)

It’ll look something like this. That’s it.

If your 401(k) plan lets you set a dollar amount instead of a percentage, the same idea applies; just figure out how much is 1% of your salary.

Take It One Step Further By Enabling Auto-Escalation

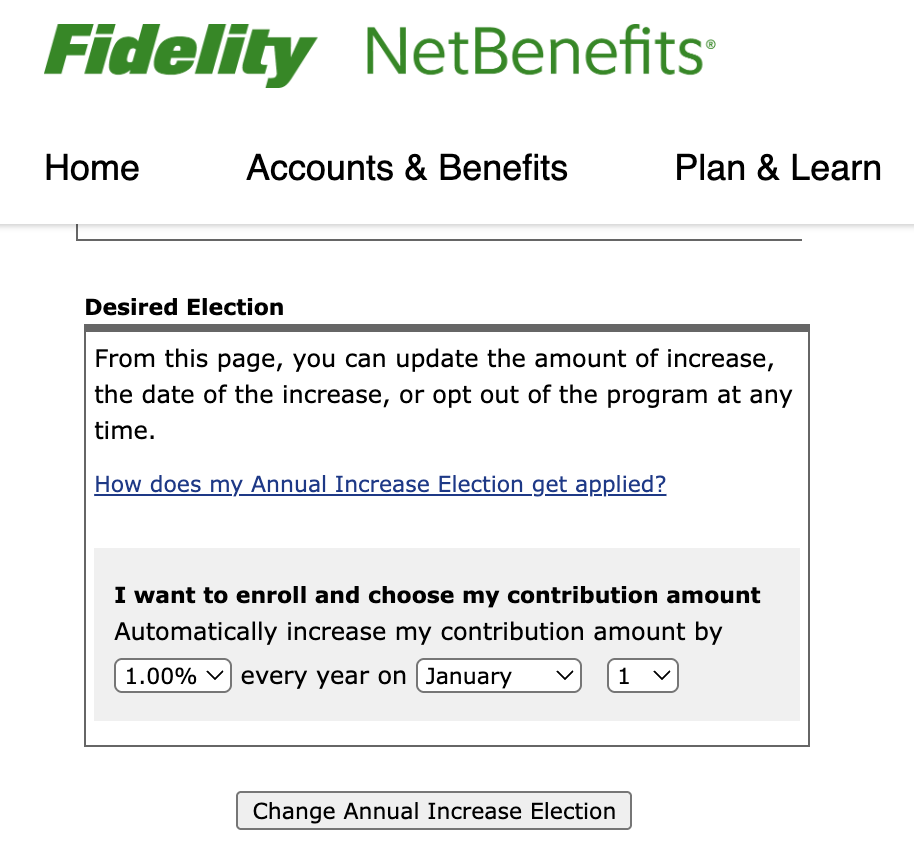

Some plans offer an “auto-escalation” feature, also called an “annual increase” program, that automatically increases your 401(k) contribution percentage each year on a certain month, without you having to remember.

You can set your contribution to increase by 1% until you reach a cap you set or the contribution limit. You get automatic wealth building, which is the best kind of wealth building.

If you decide to turn it on today, your plan takes care of the rest. No annual reminder or to-do list needed.

Here’s what this feature looks like in Fidelity’s 401(k) as an example:

How It Could Make You A Multi-Millionaire

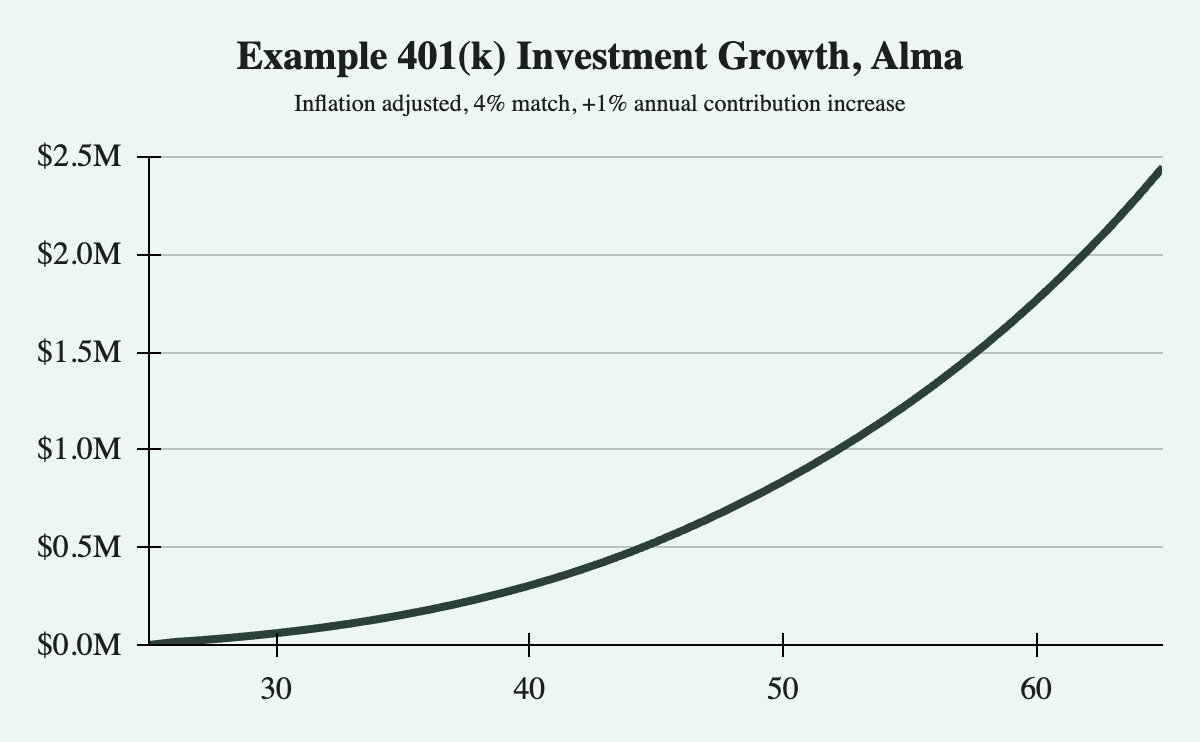

Let’s look at an example. Alma is 25 years old and earns $75,000. She expects 3.5% annual raises. She is currently contributing 5% to her 401(k), and her employer matches 4%.

She decides to implement this tactic to increase her contribution by 1% each year. How much is that worth?

By age 60, she’ll have over $2.4 million in her 401(k), adjusting for inflation and assuming an 8% return.

This is Part of a Wealth Building Framework

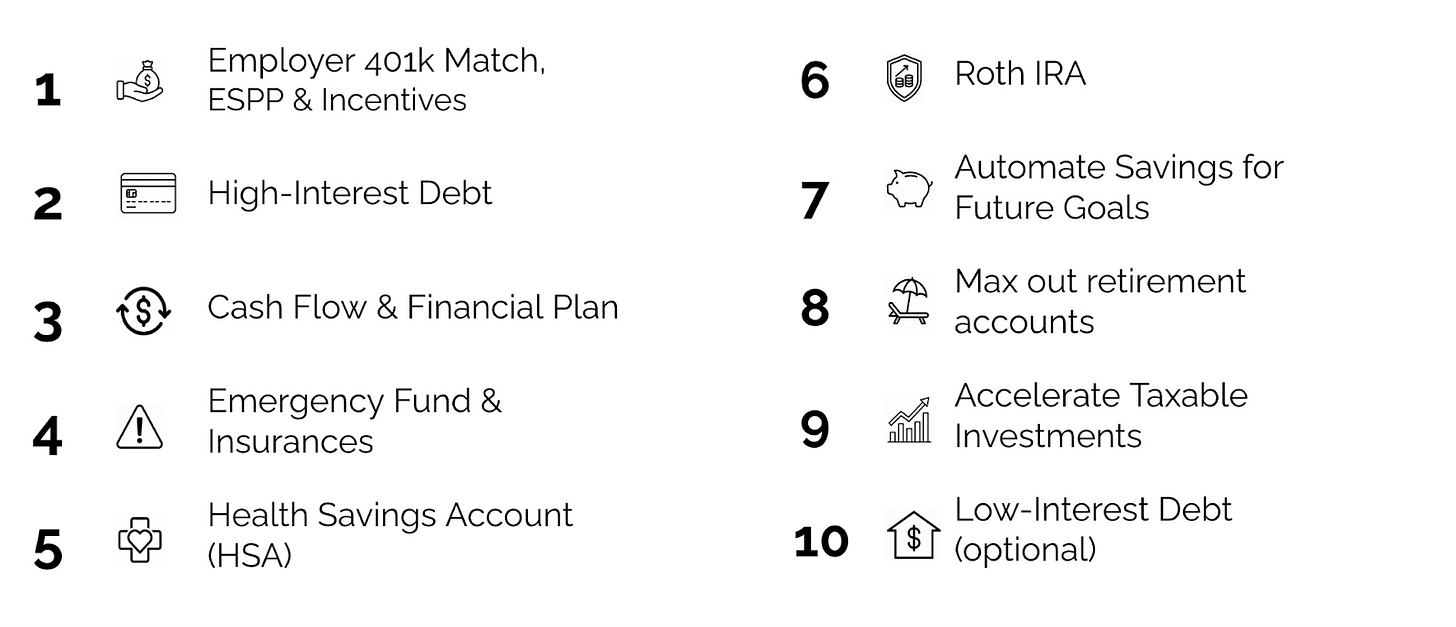

The 401(k) raise tactic is Step 8 in my 10-step framework for building life-changing wealth. Step 8 is where you max out your retirement accounts.

Ideally, you’d handle these things first.

Get your employer match (Step 1): If your employer matches retirement contributions, contribute at least enough to get the full match before anything else. It’s free money.

Pay down high-interest debt (Step 2): Credit cards, payday loans, personal loans - anything above 7% interest.

Build your emergency fund (Step 4): 3-6 months of essential expenses in a high-yield savings account.

Max out your HSA (if available) (Step 5): If you have access to a high-deductible health plan, HSAs offer triple tax advantages that beat even a 401(k).

Max out your Roth or Backdoor Roth IRA (Step 6): These accounts give you tax-free growth and tax-free withdrawals in retirement.

Automate savings for future goals (Step 7): Set aside about 5% of your gross income for major expenses, like travel, a car replacement, or a down payment on a house.

That’s the perfect order to optimize your financial life. You can see the complete framework with detailed explanations in my posts on The 10 Steps To Building Life Changing Wealth.

That being said, don’t let perfect be the enemy of good. You can do this step in parallel with others you are working on.

If you want one of the easiest ways to increase your retirement savings, go ahead and bump your 401(k) percentage now. This strategy is powerful even if you haven’t checked every other box. Getting started early matters more than waiting for perfect conditions. No one ever said, “I wish I waited longer to save for retirement.”

If You’re Ready, Do it Now

Log in to your 401(k) and increase your contribution by 1% today. If your plan allows it, set up automatic annual increases for every January or whenever you typically get raises.

It’s quite possibly the easiest way to build wealth without having to spend less.

For more on common 401(k) mistakes and how to avoid them, check out my post on common investment mistakes and a 401(k) FAQ, including what to invest in and how to choose between Roth and Traditional 401(k), if you have the option.

FAQ

What if I’m already contributing a lot? How much is enough to contribute to your 401(k)?

Assuming you’re starting in your 20s, traditional advice is to invest 15% of your gross salary to retire by 65. That includes your employer match and all retirement investing - 401(k)s, IRA, and taxable.

Want to retire earlier? You’ll need to save a higher percentage. For example, to retire in your 50s, you’ll need to invest at least 25-35%. See the table here where I go through this question in my 10-step framework for building wealth.

Disclaimer: This article is for general education only. It isn’t personal financial advice. I don’t know your full situation, goals, or risk tolerance, and nothing here should guide your decisions on its own. Do your own research or speak with a licensed professional before acting on any investment ideas.