Do a Backdoor Roth IRA the Right Way

How a Backdoor Roth actually works for high earners and how to avoid the one mistake that triggers taxes.

Here’s a finance secret. It’s easy to pay $0 federal income tax in retirement. Even spending $150k+ per year. It all starts with a word: Roth.

Today, I am going to show you how to do a Backdoor Roth IRA. Use it to invest and avoid future taxes, regardless of income.

Many people can avoid federal taxes entirely in retirement by using a Backdoor Roth with traditional and taxable accounts.

I plan to save hundreds of thousands of dollars in taxes over my life. That’s why a Backdoor Roth is one of my 10 steps to life changing wealth.

What is a Backdoor IRA?

The Backdoor IRA isn’t a separate account. It’s a two-step process to avoid contribution limits. If you execute this before year-end, you’ll minimize paperwork headaches and keep your taxes clean.

The term backdoor refers to converting your money instead of contributing to it directly.

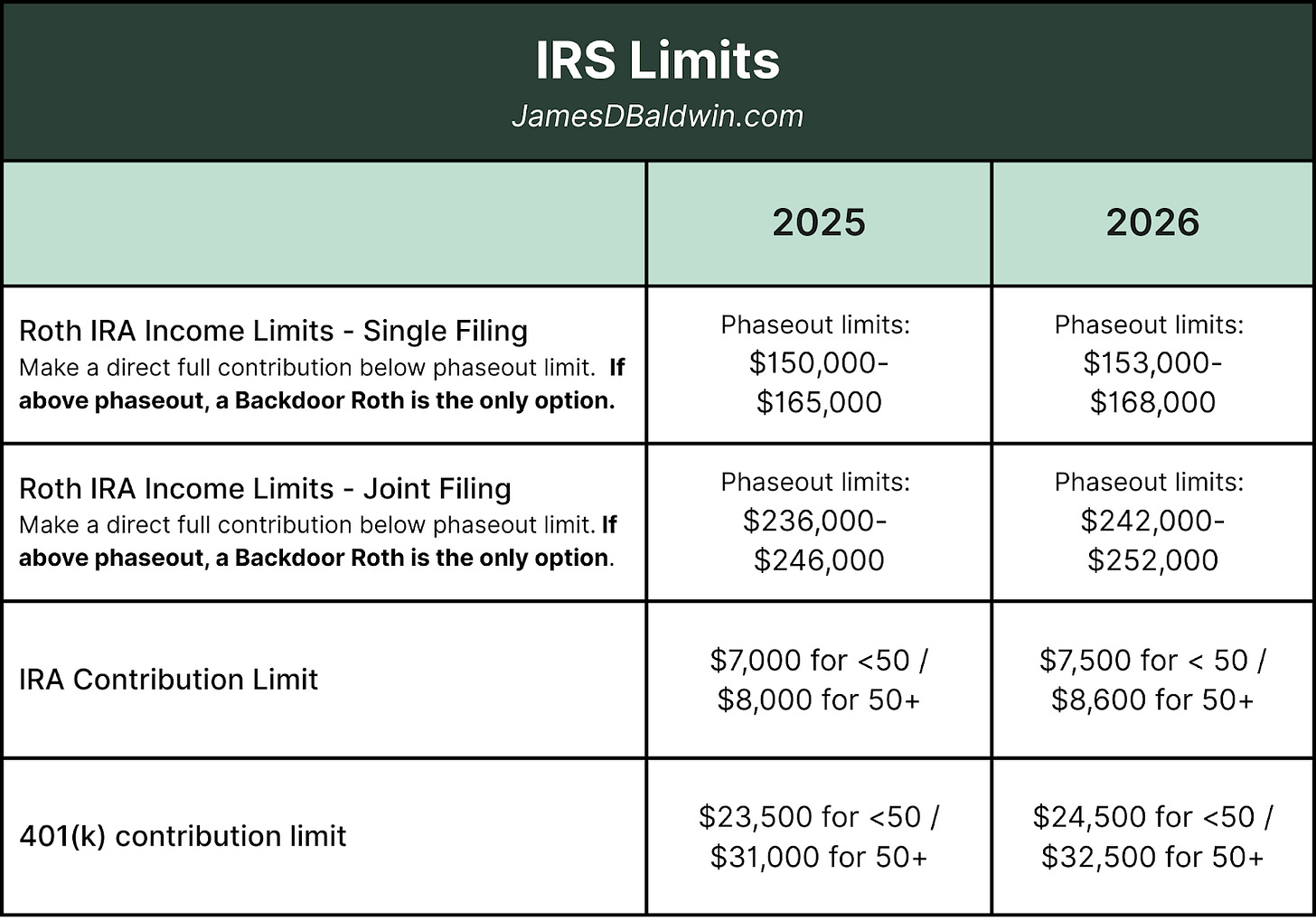

Why would you need to do it this way? Because there’s an income limit on direct contributions. Check the table below to see if you are over the limit.

If you are over the phaseout limit, you lose the direct contribution option. You must use the Backdoor Roth two-step process. You still get access to the same tax-free growth of a Roth IRA.

2025 and 2026 Limits. Do you need to do a Backdoor Roth IRA?

You need to do a Backdoor IRA if your income exceeds the phaseout limits in the first two rows, depending on whether you file separately or jointly.

Timing: Do the contribution and conversion before December 31

I recommend doing both the contribution and conversion steps before December 31st. Your tax return is much simpler if you complete both the contribution and the conversion within the same calendar year.

Technically, you can make an IRA contribution until Tax Day in April of the following year. But it can make the paperwork more complicated. That’s because the IRS will look at your total IRA balance on December 31 to calculate taxes on conversions.

The biggest challenge: The Pro Rata Rule

The “pro rata rule” is the place most likely to cause you problems. Get this wrong, and you could end up with an unexpected tax bill.

Understanding the pro rata rule: If you have other Traditional IRAs in addition to the amount you want to convert, you will trigger taxes. That is bad. You can avoid taxes if you don’t have any other Traditional IRA accounts. That is better.

⚠️ Check this first

Do you have any other Traditional IRA accounts? That includes all types of Traditional IRAs, including Rollover, SEP, and SIMPLE IRAs.

If you DON’T have any other Traditional IRAs, great! You aren’t at risk of triggering the pro rata rule. You can skip to the section on how to do the Backdoor Roth IRA.

If you DO have other Traditional IRAs, you need to understand the pro rata rule and your options. Read on.

How the pro rata rule works

On December 31, the IRS looks at all of your Traditional IRAs as one big bucket of funds. Not only the amount you have converted.

When doing a conversion, the IRS assumes you pull a mix of dollars from all of your accounts. Yes, even if you only pull money from one account. They ignore that fact. They look at the overall mix and charge tax on it in proportion. That includes:

After-tax dollars. These are the amounts you contributed this year and want to convert through the Backdoor Roth IRA, and

Pre-tax dollars from your other traditional accounts

The Pro Rata Trap Example

Let’s say you have:

Existing pre-tax Traditional IRAs: $93,000

New non-deductible (ie, after-tax) contribution that you want to convert through a Backdoor Roth: $7,000

Total IRA balance on December 31: $100,000

If you convert $7,000, only 7% of that amount is tax-free under the pro rata rule. The remaining 93% would be taxed.

On the other hand, if you did not have the $93,000 in other Traditional IRA accounts and those were in your Traditional 401(k) instead, then you aren’t taxed at all. The entire $7,000 is converted to a Roth without being taxed.

What DOESN’T Count (These are Safe)

The good news: all 401(k), 403(b), 457, TSP balances, HSAs, and other Roth IRAs don’t count. These do not trigger the pro rata rule.

The Fixes (If You Have a Balance)

Option 1 (Best): Reverse-roll over your old IRA into a current 401(k), which removes the problem. Call your 401(k) provider to start the process immediately so it can finish before December 31st.

Option 2 (Exercise caution): Deliberately convert your entire amount of Traditional IRA to Roth. This is a real tax decision because it will be taxed. It can be worth considering if you expect higher future tax rates or if your balance is very small. But make sure you understand the tax implications or consult a tax professional.

How do the Backdoor Roth IRA: Step-by-Step

Pre-Work

Double-check you are over the income phaseout. If you are under the phaseout limits, you can contribute to a Roth IRA directly and avoid the extra conversion step.

Double-check for the pro rata rule. Confirm you have no pre-tax Traditional IRA balances. Traditional, Rollover, SEP, and SIMPLE IRAs should total $0 on December 31. If not, see the section above.

Open the Accounts. Open a “Traditional IRA” and a “Roth IRA” with your investment brokerage. You need both accounts. If you don’t have one, Vanguard and Fidelity are good options.

Step 1: Contribute to the Traditional IRA

Contribute to your Traditional IRA account up to the annual limit ($7,000 in 2025, or $8,000 if you’re 50+). This is a non-deductible (ie, after-tax) contribution because you are over the income limit and covered by a workplace plan. That’s what we want here.

The money will usually be deposited into a settlement fund or money market holding account. That’s fine. We don’t need to invest them yet.

Now you need to wait for the funds to settle before moving to the next step, which typically takes 1-5 days if you transfer from a bank. Wait at least one day if the funds settle the same day before taking the next step.

Step 2: Convert 100% of What You Contributed

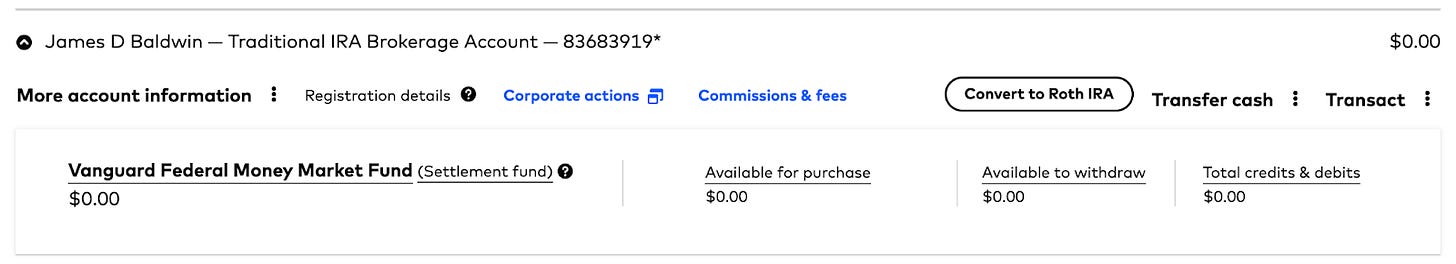

Once the funds have settled, do the conversion.

Go to your Traditional IRA account and find the option to “Convert to Roth” or “Transfer” in your brokerage account.

Move the entire balance, including pennies and interest.

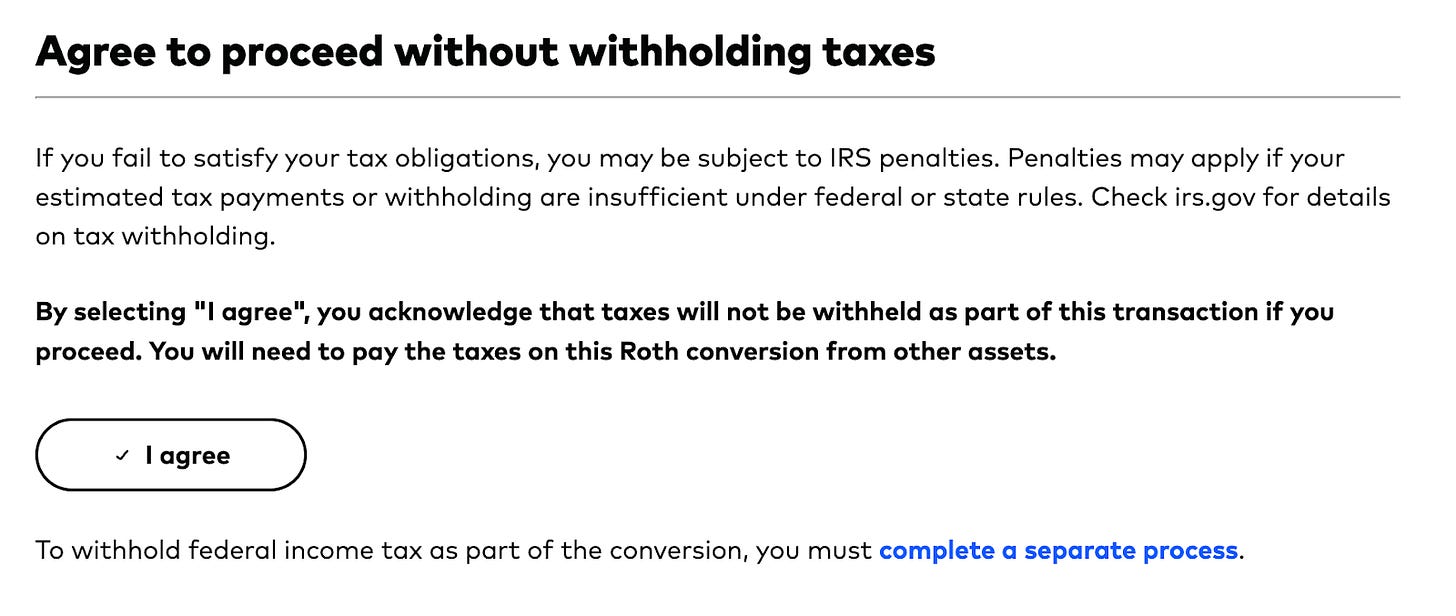

Tax Withholding: Select 0% (NO). You already paid tax on the contribution money.

In Vanguard, you would see:

Step 3: Invest Your Money

Don’t forget to invest your money!

A target-date fund is always a good option for a retirement account, such as an IRA. If you want to control how much you put in stocks, you can choose your own allocation with a simple index fund. I share my pick for the single best investment for long-term wealth here.

The Paperwork: Tax Time (Form 8606)

When tax time rolls around, you will receive a Form 5498 for the contribution to the Traditional IRA and a 1099-R for the conversion.

In your tax return, you will need to fill out Form 8606. It is mandatory. This form tells the IRS: “I made a non-deductible contribution, and then I converted it to Roth. Please don’t tax me twice.”

Make sure you ask your tax preparer to confirm that they understand how to report a backdoor Roth IRA contribution and fill out tax form 8606 correctly. If your tax preparer isn’t familiar with the term “Backdoor”, explain to them you made a “non-deductible contribution” and then “conversion to Roth”. Those are the technical tax terms.

If you’re doing it yourself with TurboTax or H&R Block, you must explicitly answer “Yes” to “Did you make non-deductible contributions?” That will trigger the software to walk you through Form 8606. TurboTax used to make this very complicated, but they’ve recently made this a little easier. This video has a helpful TurboTax walkthrough.

You’re done!

If this process feels complicated the first time, that’s normal. But the mechanics are simple once you have done it. The important part is avoiding the pro rata trap and keeping your paperwork clean. Do it carefully the first year. After that, it becomes routine.

The Backdoor Roth is one of the most powerful tools for controlling taxes later, not just saving them today. It gives you real flexibility over where your retirement income comes from and how much tax you owe. That flexibility is how many people legally drive their federal tax bill down to $0 in retirement.

If you want to save a ton of taxes, this is one of the highest-impact places to start. It’s a key part of my 10 steps to building life changing wealth.

In summary:

Log in to every brokerage and retirement account to have and confirm balances in Traditional, Rollover, SEP, and SIMPLE IRAs. (Remember, you can ignore all 401(k) accounts.)

If Total > $0: Check if your current 401(k) accepts roll-ins. Call your 401(k) to start that paperwork immediately.

If Total = $0: Open Traditional and Roth IRAs.

Contribute up to the annual limit per person to Traditional.

Convert 100% to Roth once settled.

Invest the funds. Don’t leave them in cash.

Save your 1099-R, 5498, and Form 8606 for tax season. Double-check your tax preparation.

Frequently Asked Questions

“Is it worth it? It looks like extra work over putting the money in a taxable account.”

Yes, these steps will likely save you tens of thousands of dollars in taxes over your lifetime. Importantly, more money in a Roth allows you to control your tax bill in retirement, which is incredibly important when you start taking required minimum distributions and want to benefit from ACA subsidies. That said, for people who are already multi-millionaires, where $7,000-$16,000/year in tax-free investing doesn’t really matter to your lifestyle, you could skip it.

“When should I do it?”

As soon as you have the funds. The earlier in the year, the better. Many people aim to do it in the first week or two of January each year. This allows you to invest in your Roth IRA as soon as possible and maximize the time your investment can generate compound growth. But that assumes you have the cash to contribute.

Regardless of when you contribute, aim to do the conversion once. It can make the paperwork more complicated to convert multiple times within the same year.

“Is this the same as the Mega-Backdoor Roth?”

No. The “Mega-Backdoor” involves after-tax 401(k) contributions. Although the names are confusingly similar, they are entirely separate strategies. You can often do both.

“I earned ~$3.50 (or some other amount) interest while waiting. What should I do?”

It’s common to have a small amount of interest if your original $7,000 contribution to the traditional IRA has been sitting there a while. It’s fine. Just convert it too. You will pay ordinary income tax only on the $3.50, which would be about a dollar in taxes. No big deal.

“I already contributed directly to a Roth but realized I’m over the limit. What now?”

You likely need to do another step first: Recharacterize that contribution to a Traditional IRA, then you can convert it using the process described above. Search for “recharacterization” on your brokerage site.

“What are the downsides?”

These are still retirement accounts that come with similar constraints as other retirement accounts. The biggest of which is waiting until 59½ to access the earnings. Although you can access the principal in a Roth IRA account if it has been in the account for at least 5 years.

Disclaimer: This is for educational purposes only. Make sure you understand the tax implications of your situation and that you are reporting it correctly on your tax return. If you are unsure, verify all details with a tax professional.