Should You Invest Now? Here’s What I Told a Friend With Cash

If you're unsure whether to keep cash in savings or invest during a volatile market, this framework will help you think through the options and tradeoffs.

I recently got this question from a friend:

“Let’s talk market. I know you’re not selling (neither am I). But are you buying?

I do have a solid chunk of cash in savings. Which is good for a recession and uncertainty, but I’m also tempted to invest some of it… but obviously, markets could tank even more.

The cash is earmarked for a few different things, mostly for a house down payment, emergency fund. I can’t see buying a house in the next year or so. But that cash is comforting.

What would you do?”

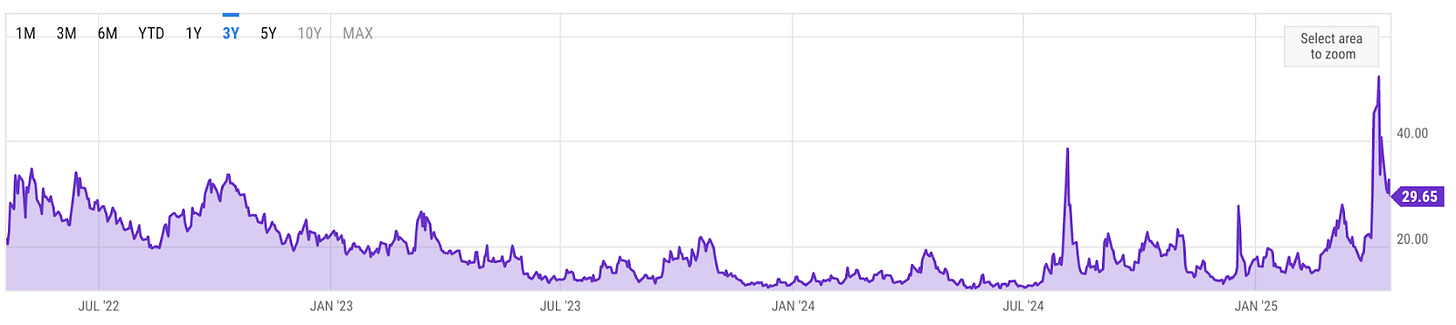

The market has been a wild ride over the last few weeks. As you’ve no doubt heard, a surprisingly massive tariff announcement caused the S&P 500 to drop over 10% in two days. The market was nearly 19% down from its last peak.

Then, the index rebounded almost 9% after the policy was temporarily reversed, marking the 10th best day in history1! The sharp swings have continued, and the market is currently in correction territory.

The story isn’t just the volatility. It’s also the mood. Investor sentiment is deeply negative. According to a recent AAII survey, 57% of individual investors said they were bearish, marking eight straight weeks of pessimism2. That kind of streak hasn’t happened in over 35 years. Fed Chair Jerome Powell recently pointed out that new trade policies are weighing on consumer and business confidence, adding uncertainty to an already fragile economy.

Back to our question - what if you had some extra cash right now?

If you’re still a ways away from and sitting on some cash you don’t need immediately, it’s fair to ask: Should I invest it?

To help answer this, I will lay out some options here for you to use as decision-making tools. They are designed to help you think through what fits your own situation. Each path has its strengths and trade-offs.

Use them as starting points to align with how you think about risk, what you want this money to achieve, and when you might need it. Then adapt as needed. As always, your approach should reflect your risk tolerance, time horizon, and the purpose of the money.

The Safe Option: High-Yield Savings or Short-Term Treasuries

Cash rarely pays this well. Right now, you can actually earn something on your savings. High-yield savings accounts and short-term Treasury bills are paying between 4% and 5%. Pre-2022, yields hovered near zero. Now, they can at least keep pace with inflation.

If your timeline is short and your goal is to keep your cash safe for a down payment, this is the least stressful path. You avoid market losses and still earn a little return.

This option would make sense for anyone who needs access to the full amount relatively soon or for an investor who prefers to take less risk.

The trade-off here is that you won’t benefit from a market rebound. If stocks gain 15% in a year, your 4% return will feel disappointing. Still, for short-term money, this is a risk-managed play. And, given that current rates are exceeding inflation, you aren’t running a risk of losing purchasing power. At least in the short term.

The Invest Option: Dollar-Cost Averaging into Index Funds

Instead of investing all your cash at once, you can invest smaller chunks on a set schedule. This smooths out your entry into the market, a strategy called dollar-cost averaging (DCA).

You reduce the risk of buying in at the wrong time. If the market drops next month, you’ll buy at lower prices. If it rises, at least part of your money was already invested.

This option is for investors with some risk tolerance who want long-term growth but are concerned about jumping in all at once. With the wild swings we've seen over the last few weeks, that’s a very legitimate concern.

It’s also a good fit if you don’t expect to need the cash soon and could let the money stay invested.

The trade-off with dollar cost averaging is that it often results in lower returns than investing all of your money upfront when markets are rising (called “lump-sum investing,”) but it is a good behavioral strategy. It gives you a way to move forward without waiting for the perfect moment or taking on an unreasonable amount of stress.

Historically, studies show that lump-sum investing outperforms dollar cost averaging about 75% of the time3. But in volatile markets, dollar cost averaging helps you stay invested without overthinking each move. During the 2020 COVID crash, for example, regular investments would have captured the recovery even as the news cycle was scary.

The Hedge Option: A Barbell Strategy

With this strategy, you keep most of your money in safe assets and allocate a smaller portion to the stock market. For example, put 75% of your cash in a high-yield savings account or T-bills, and 25% in stock market index funds.

With this strategy, you can participate in the market upside without putting everything at risk. If stocks soar, your 25% allocation benefits. If they tank, 75% of your money is safe.

This is for more cautious investors who want growth but can’t afford big losses. It’s also great for people who want to hedge their bets against best- and worst-case scenarios.

The trade-off here is that if the market rallies hard, you’ll wish you had more invested. But you get peace of mind in return. This approach is less about maximizing returns and more about getting some money invested with less stress.

The barbell strategy has worked well in past crises when investors wanted some exposure but couldn’t stomach a full risk position. Nassim Nicholas Taleb has written about its use in protecting against extreme outcomes4.

Final Thoughts

There is no one right answer for what to do with a chunk of cash in today’s market. But there are good options that can help you think through what to do to best meet your comfort with risk, your timeline, and your goals.

You can:

Keep it safe and earn a solid return with high-yield savings or T-bills

Invest slowly to reduce timing risk using dollar cost averaging

Mix safe and risky assets for balance with a barbell strategy

Or you can combine strategies. For example, you might keep half in cash and invest half slowly over time (barbell + dollar cost averaging). That kind of split allows you to stay flexible and respond to changes in your needs or the market.

If you plan to buy a home soon or some other major purchase, the need for safety may outweigh the lure of growth.

If you're holding the money with no firm timeline, you have room to take more risk.

Either way, the best strategy is the one that you feel comfortable with.

https://www.usicg.com/publications/market-volatility-update-april-2025/

https://www.benzinga.com/25/04/44860877/bearish-sentiment-surpasses-35-year-old-streak-breaking-all-records-hovers-above-50-for-eight-consecutive-weeks

https://www.northwesternmutual.com/life-and-money/is-dollar-cost-averaging-better-than-lump-sum-investing/

https://www.mmrao.com/post/barbell-strategy-by-nassimtaleb#:~:text=A%20Barbell%20strategy%20consists%20of,thus%20creating%20a%20potent%20mix