It's Not Only Gold! How to Stagflation-Proof Your Portfolio

If prices run hot while growth cools, the usual ‘cash and bonds’ playbook can fail. Here’s a practical allocation you can implement today.

Summary

The last stagflation was worse for investors than the 2000 dot-com crash and the 2008 Great Financial Crisis, combined.

Your standard-issue “safe” cash and bonds portfolio doesn’t protect you from stagflation.

There are investment tools that you’ve heard of but aren’t yet using that can help protect you.

How to Stagflation-Proof Your Portfolio (Without Blowing Up Your Plan)

Experts are Fretting About Stagflation.

In recent months, a growing number of leading economists and central bankers have flagged the possibility that the U.S. economy may be entering an era of stagflation.

Stagflation is particularly worrying for those who have been diligently investing for a while and for those who want the freedom to step away from the 9-5.

It’s a problem for you for two reasons:

You need your portfolio to grow to reach financial independence

It’s really difficult to enjoy your money when you are watching it disappear.

What leading economists have to say:

“It seems increasingly likely that the American economy is sleepwalking toward stagflation. In case you’re wondering, that is not a good thing.” Tyler Cowen, George Mason University1

“Inflation and unemployment in the U.S. are both rising. … The Fed faces a ‘challenging situation,’ Jay Powell, its chair said”2

Nobel Prize winner Joseph Stiglitz, speaking to the Guardian, argued U.S. trade and policy uncertainty make the country “a scary place to invest” and risk triggering “the worst of all possible worlds: a kind of stagflation.”3

Stagflation: When Everything Goes Wrong at the Same Time.

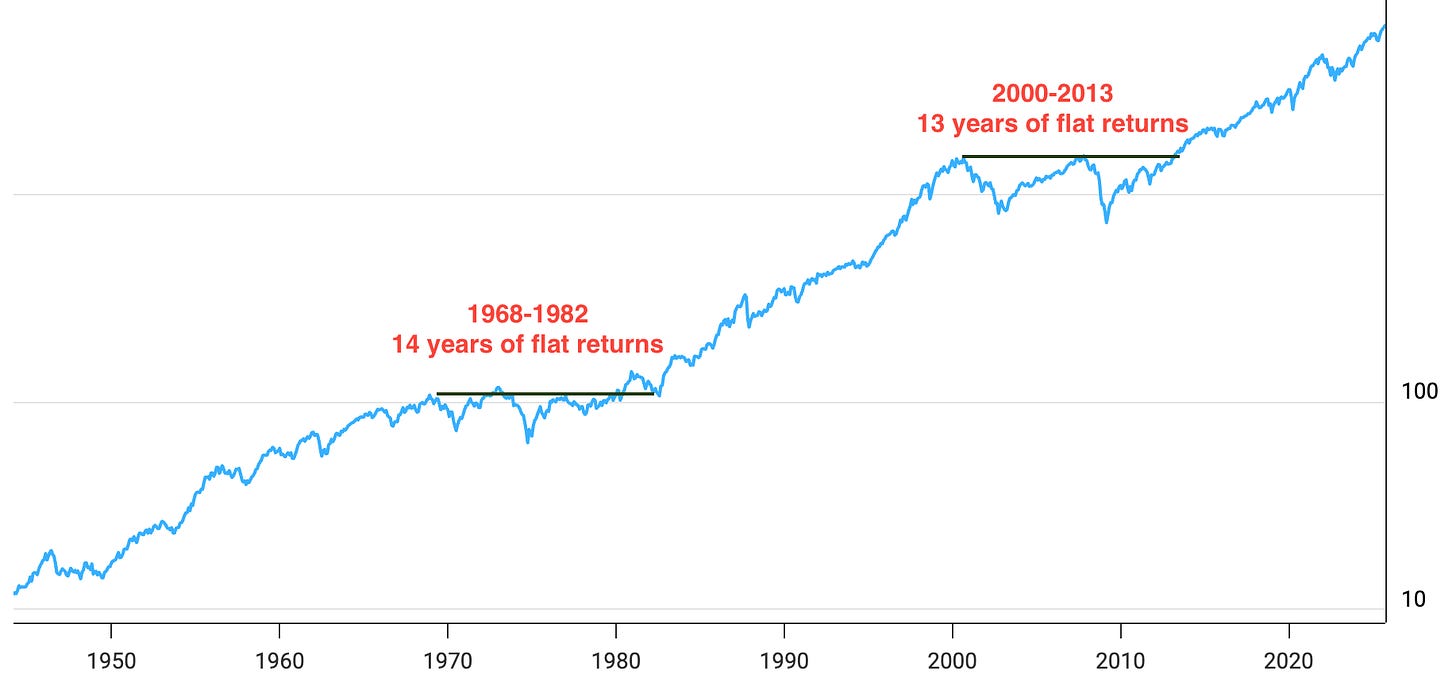

Stagflation occurs when there is high inflation, high unemployment, and weak economic growth. Stagflation defined the economy of the 1970s and led to 14 years of negative or flat investment returns. That was the worst period to invest since the great depression.

What’s happening in “Stagflation”? In simple terms, prices are rising, but the economy is not growing. Here’s how it works:

Stuff costs more → because inputs like oil, gas, or imports get expensive.

People can’t buy as much → because wages don’t keep up, and high interest rates make debt less accessible.

Businesses don’t grow → higher costs + weaker demand = layoffs, slow investment, (which amplifies #2)

Some economists didn’t even believe that stagflation was possible until it actually happened. The U.S. economy experienced a painful period of stagflation throughout the 1970s.

The previous theory was that you could not have high unemployment and high inflation at the same time, because when one goes up, it should push the other down.

We learned it was indeed possible when the 1973 OPEC oil embargo led to a price shock. Oil prices quadrupled within months. Higher energy prices pushed up the cost of almost everything. Companies faced higher costs, and job losses rose. Consumers spent more on essentials and less on other goods, resulting in slower growth.

In the 1970s, the oil price shock drove prices higher. Today, tariffs are at risk of doing the same by raising costs through the entire supply chain.

Whether we are actually in stagflation yet or how bad it could get remains to be seen. There are some indicators that we aren’t there yet. In particular, the US is still experiencing GDP growth, while other measures, such as Gross Output, are indicating weakening economic growth.4

Sequence-of-Returns Risk in Stagflation: Being Homeless vs. an NBA Salary

During our last period of stagflation, the stock market had no gains in inflation-adjusted terms for 14 years. That sounds bad. But how bad is it?

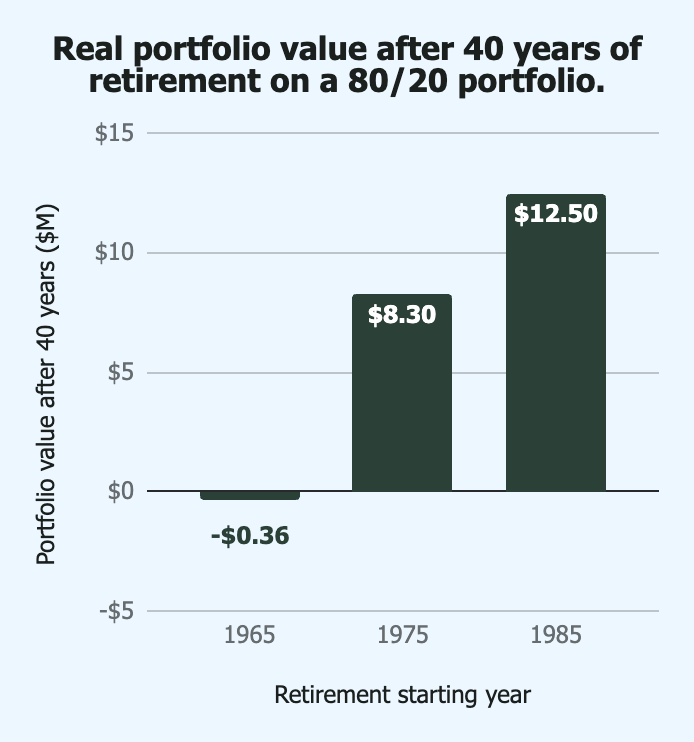

Let’s examine a case study of financially independent retirees living off their portfolio. We’ll assume they have a $1 million portfolio, consisting of 80% stocks / 20% bonds, and are living off 4% annual withdrawals.

Retirement start year vs ending real balance

Case 1: Homeless

Retired before stagflation in 1965

Portfolio after 40 years: Negative -$0.4M

They would have run out of money in about 30 years!

Case 2: Rich

Retired during stagflation in 1975

Portfolio after 40 years: $8.3M

Notice the difference in missing just half of stagflation. Like wearing a seatbelt, you just need to survive the worst.

Case 3: NBA Salary

Retire after stagflation in 1985

Portfolio after 40 years: $12.5M

That’s about an average NBA salary.

Conclusion: The period leading up to stagflation poses by far the most risk for investors. That could be the period happening right now.

How to understand the critical concept of Sequence-of-Returns Risk

The difference between our homeless outcome and NBA salary outcome is due to stagflation, and it’s also related to a type of risk known as sequence-of-returns risk, which can occur when there is any period of poor market performance early in retirement (stagflation being just one example).

The “sequence” term refers to the fact that the risk is higher if your portfolio declines occur at the beginning of retirement compared to toward the end. The reason it’s so devastating when it happens at the beginning of retirement is that you are withdrawing from your portfolio to pay bills while your portfolio hasn’t produced any gains to fund your withdrawals. Your portfolio gets smaller and smaller to the point where future stock market growth can’t replenish your portfolio. And then you run out of money. 🙁

Reminder: The Risk of Ruin, aka running out of money, is enemy #1.

Now, let’s turn to how to update our portfolio in light of the growing risk of stagflation today.

Stagflation Portfolio: What to do to protect yourself from Stagflation

Our goal here isn’t to make huge amounts of money. It’s to stop the bleeding and preserve our wealth while everyone else is losing their shirt. Two investments stand out to help us here.

Reminder: This is a fairly advanced asset allocation strategy. It’s important, but other things are more important to do first; make sure you are doing those first so you aren’t leaving the easy money on the table.

1.) Hold international stocks:

Portfolios with international stocks tend to do better in those periods because you aren’t relying on only the US economy. Even when the U.S. economy is dragging down the global economy, generally, there will be other countries doing better.

The dollar matters too. A weak dollar boosts returns for U.S. investors holding international stocks, while a strong dollar can cancel those gains.

Many passive investors already hold international stocks. If you don’t, now is a good time to add them.

How much should you add?

Following a passive index strategy, you would evenly diversify across the entire world. That splits your stock investments proportionally across all of the world’s stocks.

Today, your portfolio would be split approximately two-thirds into U.S. stocks and one-third into international stocks, although the ratio fluctuates over time.

There are index funds that buy the whole world’s stocks for you. It’s easy to just put all of your stock investments into one of these funds. Some fund options that I like:

Vanguard Total World Stock Index (Ticker: VTWAX or VT, Expenses: 0.06%)

SPDR Portfolio MSCI Global Stock Market ETF (SPGM, Expenses: 0.09%)

iShares MSCI ACWI ETF / fund (ACWI, Expenses: 0.32%)

If you currently have a sizable amount in U.S. stocks that you don’t want to sell. In that case, you can instead add an international stock market fund to your portfolio and make future investments in this new fund to slowly grow your international allocation. You would buy a fund that holds all the stocks outside the US, such as Vanguard Total International Stock Index (VTIAX or VXUS).

2.) Add inflation protection with TIPS and/or Gold

TIPS

Treasury Inflation-Protected Securities (TIPS) are tied directly to inflation. When inflation goes up. TIPS values are periodically adjusted to cover the inflation increases, so you preserve the real value of your investment and still earn interest.

TIPS are directly indexed to inflation, so they preserve their value if held to maturity. Therefore, they provide reliable protection during inflation and stagflation. Adding TIPS to your portfolio gives you a pot of money that you know will grow, no matter what happens in the market. The tradeoff is that the growth tends to be slow.

The amount you choose should be based on your timelines, goals, and risk appetite. Generally, the closer you get to retirement, the more you want to hold in these kinds of safe investments to protect your portfolio from sequence-of-returns risk.

Many financial planners recommend having a safety bucket of 2-5 years of expenses so that you are not forced to sell equities during a downturn. TIPS are a good candidate to be part of your safety bucket, especially during periods of inflation.

Some fund options that buy TIPS for you are:

Vanguard Inflation-Protected Securities (VTIP, Expenses: 0.03%)

Schwab U.S. TIPS ETF (SCHP, Expenses: 0.03%)

Fidelity Inflation-Protected Bond Index Fund (FIPDX, Expense: 0.05%)

You can also buy TIPS directly from the U.S. government at treasurydirect.gov.

Gold

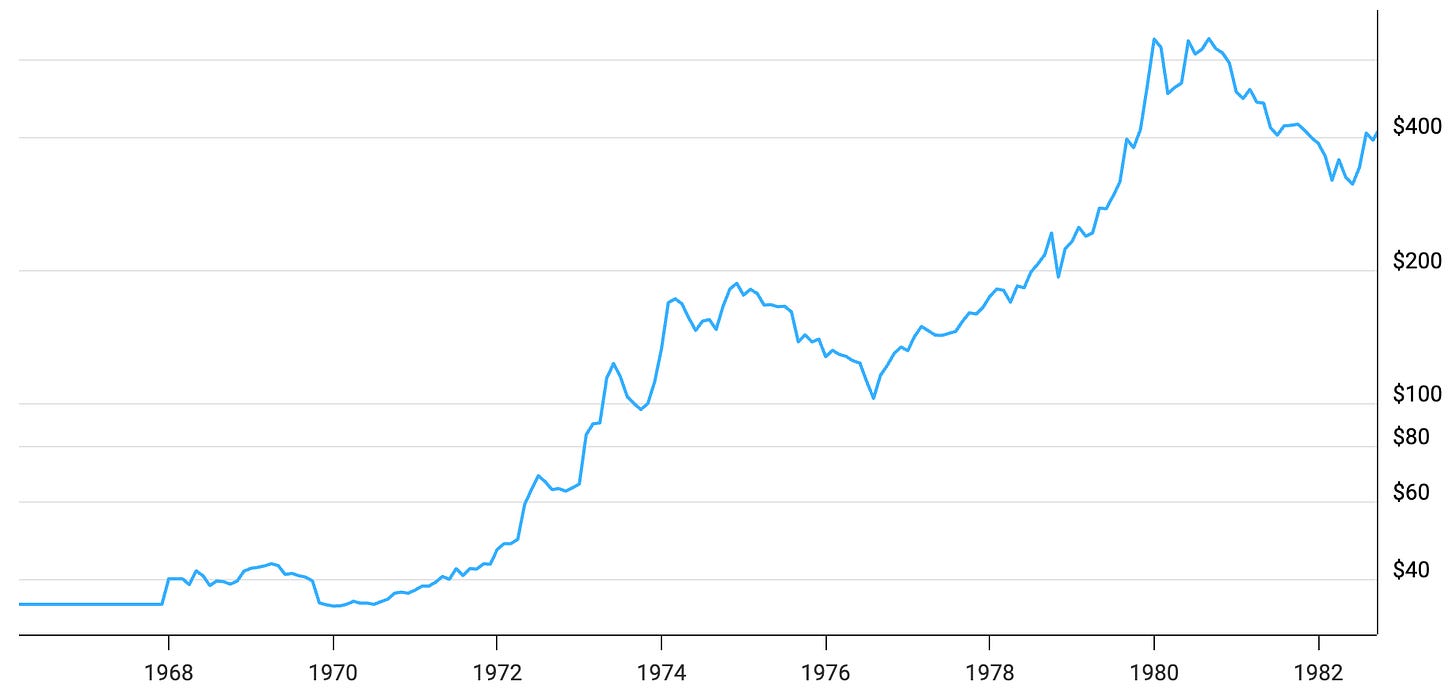

Gold often benefited from supply shocks and rising input costs, like the 1970s stagflation. Gold prices tend to increase during periods of inflation.

In particular, gold is an investment that people often flock to when the economy is uncertain, inflation is high, or there is weakening trust in the US economy and the US Dollar.

Gold performed extraordinarily well in the 1970s, while the stock market struggled.

Today, gold is also a hot commodity. The price has increased by over 35% so far this year.

If you’d like to add gold to serve as a hedge against stagflation and other major crises, most portfolios tend to recommend 5-10% of your portfolio. However, this will again depend on your goals, timelines, and risk appetite. For example, Ray Dalio suggests a 7.5% allocation to gold in his All-Weather Portfolio, which is designed to handle any economic environment, including inflationary periods.

Here are some fund options that allow you to invest in gold. Each has low expense ratios and holds physical gold bullion in vaults, so you actually own a fraction of their gold:

iShares Gold Trust (IAU, Expenses: 0.25%)

Aberdeen Standard Physical Gold Shares ETF (SGOL, Expenses: 0.17%)

SPDR Gold Shares (GLD, Expenses: 0.4%)

These changes help you manage risk, but there’s no free lunch

Adjusting your portfolio with some of these suggestions could provide significant protection if stagflation or inflation gets worse.

As with all investing, it comes with a tradeoff. In years when the US stock market is doing great, you would be giving up some of the return. So don’t sell all of your US stocks. Stay diversified and be ready to benefit from whatever happens in the world.

Think of it as a seatbelt for your portfolio. If you are nearing retirement, this is even more crucial to protect yourself from outliving your money.

Implementation best practices

Whenever you make changes to our portfolio, how you implement them can significantly impact your taxes and help you set yourself up for success. These best practices apply in nearly every situation, including this one.

Use broadly diversified index funds with low expense ratios. (The funds we suggested above are good examples.)

Dollar cost average (DCA) into new investments. Direct all new contributions rather than selling existing ones, so that you can make the transition gradually and avoid capital gains taxes.

Pay attention to tax location. Put bonds and TIPS in tax-advantaged accounts, like 401ks, when possible because they are less tax-efficient than stocks.

Rebalance annually or semi-annually.

Set your plan and then follow it. Avoid chasing performance by investing in investments that are doing well and changing your plan too often.

Have cash available for near-term needs and emergencies, especially if you are nearing retirement.

Avoid overcomplication with too many funds or complicated funds.

Check your plan:

Do I hold international stocks, not just US?

Do I have reasonable allocation to TIPS or some short-term Treasuries?

Do I have a set rebalancing plan and calendar?

If close to retirement, do I have a cash buffer for the first few years of retirement?

Have I written down my investment plan?

Conclusion: Protect yourself from stagflation

The risk factors for stagflation in the U.S. are growing and worrying. There are several adjustments you can make to your portfolio to protect yourself by investing internationally and incorporating inflation protection through TIPS and/or gold. As always, implement these changes carefully to minimize taxes and meet your goals.

Are you taking any other steps to protect against stagflation or inflation? Leave me a comment below and let me know how you are protecting yourself.

FAQs

What about real estate during stagflation?

Real estate income can perform well during inflation because it has room to adjust as rents and costs rise with inflation, although higher rates can still put pressure on the value of real estate. Real estate can be a mixed bag, depending on various factors.

During the 1970s, Real Estate investment returns generally outperformed those of stocks and bonds. However, residential home values remained relatively stable throughout that period. REITs were a relatively small asset class in the 1970s, but they didn’t perform well.

What about the Crypto? Isn’t it the “digital gold”?

Despite being trumpeted as “digital gold”, it has not behaved like gold at all. During the last stock market decline and inflation spike a few years ago, BTC and other cryptocurrencies performed poorly, tracking more closely with growth stocks.

Crypto fits better in the speculative part of your portfolio, alongside private equity, stock picking, and other investments that may not be ideal but are often pursued due to their appeal and enjoyment. That being said, we have so little history with crypto that it’s hard to predict exactly what it would do in an extended period of stagflation.

Disclaimer

This post is for education only. This information is not intended as financial, legal, or tax advice, and it does not establish an adviser-client relationship. Investing involves risk, including loss of principal. Past performance does not guarantee future results. Examples are provided for illustration purposes only and should not be considered recommendations to buy or sell any investment. Consult with a qualified professional about your situation before making any decisions.

New York Times Dealbook newsletter, September 24, 2025

https://www.theguardian.com/business/2025/feb/17/joseph-stiglitz-economist-donald-trump-policies-tariffs-stagflation-risk-us-investment

https://www.wsj.com/opinion/beneath-the-gdp-a-recession-warning-fff133de?mod=opinion_lead_pos8